Cloud vs On-Premise TMS: The Strategic Decision Guide for European Shippers in 2025's Evolving Market

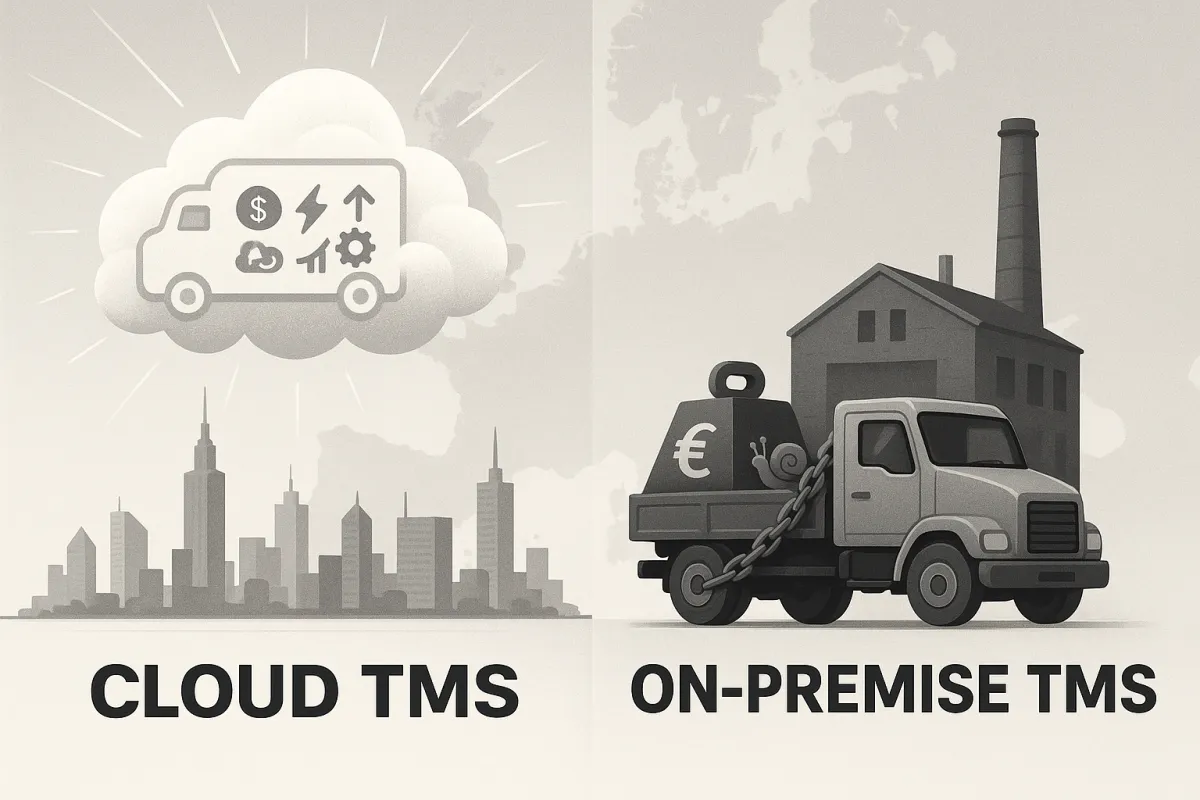

European shippers have reached a decision point that will determine their competitive position for the next decade. The European transportation management systems market, valued at USD 2.70 billion in 2022, is growing at 12.1% annually and forecasted to reach €2.1 billion in 2028, yet over 60% of companies still operate on-premise systems despite cloud deployment leading with 63% revenue growth in 2024.

This creates a critical window. Companies clinging to legacy systems while competitors leverage cloud advantages face escalating costs and diminishing returns. For smaller and mid-sized carriers, on-premise costs can quickly escalate beyond $200,000 in the first year, with annual maintenance fees continuing to compound regardless of business performance. Meanwhile, cloud deployment is expanding at 14.92% CAGR because it cuts capital costs and speeds implementation.

Understanding the True Economics: Beyond Initial Costs

Most CFOs focus on upfront licensing fees and miss the real financial picture. Licensed TMS software runs $50,000-$400,000+ with annual maintenance charges ranging from 15-20% of license costs. For a 100-truck operation, that initial $100,000 investment becomes $200,000+ in the first year when you factor in implementation, training, and infrastructure requirements.

Cloud economics work differently. Cloud TMS pricing ranges from $1.00 to $4.00 per freight load booked in the system, with costs based on variable pricing per load or annual subscriptions reaching tens of thousands of dollars. For many European shippers, this translates to predictable monthly costs that scale with business growth rather than fixed infrastructure investments.

The ROI differential is stark. Most users experience 5-10% freight cost reductions after implementing TMS, with the higher end of the scale increasing by at least 2 percentage points. Cloud solutions typically achieve these savings within 3-6 months, while on-premise implementations often require 12-18 months to show meaningful returns.

Major players like Cargoson, MercuryGate, and Transporeon offer different value propositions. High-end enterprise solutions like SAP TM typically cost $200,000-$1,000,000+ annually with significant implementation costs, making cloud alternatives increasingly attractive for mid-market European shippers.

Security, Control, and Compliance: Separating Myths from Reality

The security argument against cloud deployment often reflects outdated thinking. Google employs security and privacy professionals that include some of the world's foremost experts in information, application, and network security, with expert teams maintaining defense systems and implementing security policies. Most European manufacturers can't match this level of dedicated security investment.

However, regulatory compliance creates legitimate considerations. When personal data is transferred outside the EU, GDPR protection should travel with the data, requiring non-EU countries to have adequate protections deemed adequate by the EU. The CLOUD Act allows U.S. law enforcement agencies to compel access to data regardless of physical storage location, representing a substantial threat to GDPR compliance and sensitive data security.

European shippers in regulated industries like defense contracting, pharmaceuticals, or financial services often require on-premise control. Manufacturing and distribution enterprises rely on on-premise deployment owing to safety requirements, ease of server access, and greater control over system customization.

For most European shippers, however, the EU Cloud Code of Conduct provides an approved and European Data Protection Board-endorsed GDPR compliance solution designed for cloud deployment, addressing many regulatory concerns while enabling cloud benefits.

Implementation Speed and Scalability: The Competitive Advantage Factor

Cloud TMS implementations often conclude within eight weeks, compared to 6-18 months for traditional systems. This speed difference matters when European transport regulations change frequently or when expanding into new markets.

Consider scalability challenges. A German automotive supplier told us their on-premise system required additional hardware procurement and IT resources when they expanded from 130 loads per day to 200 loads following a new contract. The cloud-based competitor in the same tender managed this 130-load increase without additional systems or headcount.

Cloud-native systems are architected for API-first integration, enabling seamless connections with electronic logging devices, accounting software, fuel card systems, and shipper portals. This integration capability eliminates costly middleware requirements that traditional systems demand.

Key players address this differently. Cargoson offers direct API/EDI integrations with carriers across all transport modes, while Transporeon connects 150,000+ carriers but many integrations are standard EDIs or PDF/email transmissions rather than true API connections.

Technology Evolution and Future-Proofing

Legacy systems create innovation debt. Cloud-based TMS solutions are expected to register the fastest growth at 18.6% CAGR due to quick setup, low initial costs, and reduced hardware requirements. More importantly, they provide access to emerging technologies without capital investment cycles.

By the end of 2024, 49% of cloud buyers had deployed predictive AI, 46% interpretive AI and 51% GenAI. On-premise systems typically lag 2-3 years behind in AI integration due to hardware limitations and update complexity.

The technology leaders understand this shift. Companies are increasingly leveraging digital twins, cloud-based analytics, and real-time performance tracking to ensure resilience and scalability. Solutions from established players like Descartes, Blue Yonder, and Manhattan Active provide continuous updates and access to latest features through cloud deployment.

European shippers working with Cargoson or similar modern platforms access these innovations immediately, while companies on legacy Oracle TM or SAP TM face lengthy upgrade cycles and additional licensing costs.

The Migration Decision Framework: When Each Model Makes Sense

The decision isn't binary. Here's how to evaluate your specific situation:

Choose cloud-based TMS when:

- Annual transport spend under €50 million

- Growth plans requiring rapid scaling

- Limited internal IT resources

- Need for frequent system updates

- Multiple locations requiring access

Consider on-premise TMS when:

- Highly regulated industry with data sovereignty requirements

- Complex customization needs exceeding standard configurations

- Annual transport spend exceeding €100 million with stable volumes

- Existing enterprise infrastructure supporting integration

- Internal IT teams capable of system management

Geographic considerations matter for European operations. The European TMS market includes local players like Transporeon, LIS, Soloplan, Generix, Mandata, and Alpega alongside global providers. Local providers often understand European regulatory requirements better but may lack global scalability.

Remember the distinction between hosted and true multi-tenant SaaS. Multi-tenant cloud systems offer no customization with all customers sharing functionality, while single-tenant structures allow customization within segmented databases.

Executing a Successful Cloud Migration: Lessons from the Field

Migration success depends on preparation, not just technology selection. Start by auditing your current carrier relationships and integration requirements. Most European shippers work with 20-30 regular carriers but could benefit from access to 200-300 qualified providers.

Infrastructure requirements are straightforward. Cloud TMS solutions need reliable internet connectivity and basic security protocols. One European manufacturer reported their cloud TMS prevented extensive cyber attacks that would have crippled their on-premise system, thanks to the provider's dedicated security infrastructure.

Change management often proves more challenging than technical implementation. Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings, but only if teams adapt their processes appropriately.

Integration planning requires attention to existing ERP systems. Whether you're running SAP, Oracle, or other enterprise software, ensure your chosen TMS provider offers proven integration paths. Solutions like Cargoson focus exclusively on shippers rather than carriers or 3PLs, addressing specific challenges of manufacturing, wholesale, and retail companies.

The most successful migrations we've observed follow a phased approach: pilot with one major lane, measure results carefully, then expand systematically. Current favorable European transport market conditions make this an optimal time to negotiate better platform terms and carrier partnerships.

Document everything. Track cost savings, efficiency improvements, and user satisfaction metrics. These data points justify expanded deployment and demonstrate ROI to stakeholders who remain skeptical of cloud migration.