Contract vs Spot Rates: The European Shipper's Strategic Guide to Balancing Procurement Approaches in 2025's Shifting Market

European road freight rates declined significantly in Q1 2025, with contract rates falling 2.3 points quarter-on-quarter and spot rates dropping more sharply by 3.8 points. Yet this downward pressure masks a more complex story for procurement professionals. The balance of power currently favours shippers, faced with carriers heading into 2025 with high cost bases despite calming inflation. But seasoned procurement teams know that today's favorable conditions won't last forever.

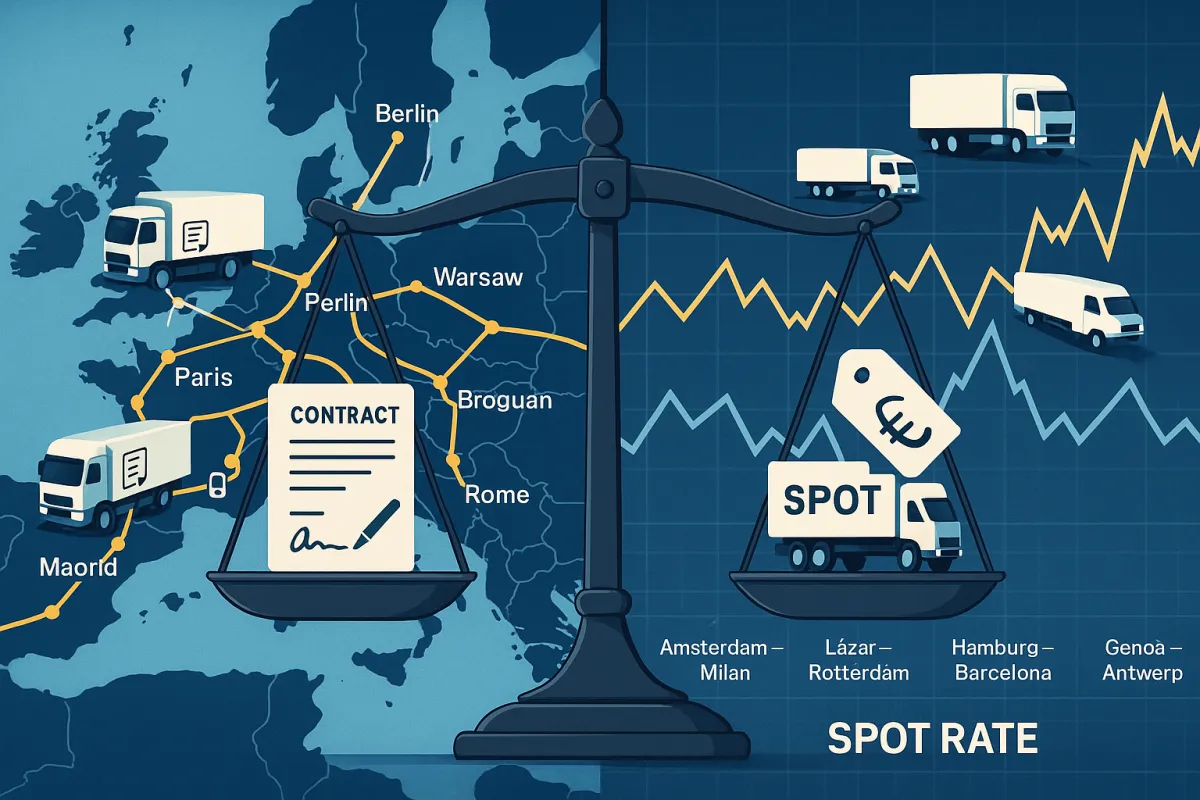

The question isn't whether to use contract or spot rates. It's how to strategically balance both approaches to maximize cost savings while securing capacity in an increasingly uncertain freight market. Moderate rate increases are anticipated alongside shifts in transport demand and compliance challenges throughout 2025, making your procurement strategy decisions today more critical than ever.

The Current European Freight Market Reality: Why Traditional Procurement Approaches Need Updating

Consumer demand remains subdued, costs have slowed their growth, and industry sentiment has been dampened as the world engages in a trade war, bringing constant uncertainty and reduced international demand for European manufacturers. This creates a unique procurement environment where traditional all-or-nothing approaches to contract versus spot purchasing no longer make sense.

Here's what's actually happening in the data. Consumer spending in Europe increased only 0.6% quarter-on-quarter, with 61% of households maintaining similar spending levels and 74% of consumers trading down by buying less or choosing cheaper retailers. This directly impacts freight volumes and pricing pressure.

European businesses are responding by fundamentally changing their procurement strategies. Companies are increasingly moving production and shipping to Poland, Romania, and Turkey to mitigate risks and reduce costs. This geographical shift means your traditional contract routes may no longer align with actual shipping patterns.

The most successful procurement teams I've worked with aren't choosing between contract and spot rates. They're building hybrid models that use contracts for baseline capacity while leveraging spot rates for flexibility. It's prudent to ensure long-term capacity based on balanced partnerships with carriers, according to Thomas Larrieu, CEO of Upply, but this doesn't mean locking everything into fixed contracts.

Understanding the Contract vs Spot Rate Fundamentals for European Operations

Contract rates provide predictable pricing through agreed-upon terms, typically spanning 6-12 months. They guarantee capacity allocation and offer budget certainty for your core shipping volumes. Spot rates fluctuate based on real-time market conditions, offering opportunities to capitalize on favorable market movements but without capacity guarantees.

The European context adds complexity. Cross-border movements involve multiple regulatory requirements, currency fluctuations, and varying fuel surcharge mechanisms. A spot rate that looks attractive for a Germany-Poland movement might include hidden costs for customs documentation or toll variations that your contracted rates already bundle.

Modern TMS platforms like Cargoson, Transporeon, and Alpega have evolved to handle both rate types seamlessly. Platforms like Cargoson, Transporeon, and Alpega allow you to create standardized tender templates, automatically populate route requirements from historical data, and distribute proposals to pre-qualified carrier networks.

The key insight most procurement teams miss: contract rates aren't just about price stability. They're capacity insurance. When market conditions tighten, carriers prioritize their contract customers. Spot shippers get squeezed out or face dramatic price spikes.

Strategic Procurement Timing: When to Lock in Contracts vs Leverage Spot Markets

Current market conditions favor strategic contract negotiations. Heavy goods vehicle registrations fell by 16% between Q1 2024 and Q1 2025, constraining new capacity entering the market. Meanwhile, the driver shortage crisis persists, with 426,000 unfilled truck driver jobs across Europe.

This capacity constraint will become more pronounced as regulatory costs increase. The Eurovignette Directive will implement additional road tolls based on CO2 emissions, and in the longer term, the ETS II (Emissions Trading System for road transport) begins in 2027, increasing fossil fuel prices.

The optimal timing strategy depends on your commodity type and route characteristics. For high-volume, regular lanes like automotive parts from Germany to France, secure 70-80% of your capacity through annual contracts negotiated between September and November. The remaining 20-30% stays flexible for spot opportunities.

For seasonal products or irregular volumes, flip the ratio. Use spot rates for 60-70% of volumes during peak seasons when capacity is tight, but maintain contract relationships for your core 30-40% to ensure you're not completely shut out during capacity crunches.

The outlook remains cautiously positive, and industry demand might exert upward pressure on rates. This suggests that Q2-Q4 2025 contracts negotiated now will likely prove favorable compared to spot rates later in the year.

The Hybrid Approach: Creating Your Optimal Contract-Spot Mix

The most effective procurement strategies I've seen use a 60-40 or 70-30 split between contract and spot rates, but the exact ratio depends on your specific business model and risk tolerance. A pharmaceutical company with strict delivery windows might use 80% contracts, while a fashion retailer capitalizing on trend-driven demand might use 60% contracts.

Your hybrid approach needs three components: baseline capacity through contracts, opportunistic spot purchases for cost savings, and surge capacity through preferred spot carriers. This three-tier structure provides cost optimization while maintaining service reliability.

Baseline capacity contracts should cover your minimum monthly volumes on core lanes. These typically run 12 months with quarterly rate reviews. Build in volume corridors rather than fixed commitments. A 20% variance allowance gives you flexibility without penalty fees.

Opportunistic spot purchases require market intelligence and quick decision-making capabilities. Modern TMS platforms offer specific capabilities designed for transport procurement automation, addressing the pain points of manual tendering while enabling more strategic decision-making.

Technology platforms like Blue Yonder, Oracle Transportation Management, and Cargoson provide real-time rate comparison tools that help you identify when spot rates drop below your contract rates. Set up automated alerts when spot rates fall 5-10% below contract rates on specific lanes.

TMS Technology's Role in Optimizing Contract vs Spot Decisions

Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings. But the real value lies in their ability to optimize your contract-spot mix through data-driven insights.

The best TMS platforms integrate real-time market data with your historical shipping patterns. They can automatically suggest when to use spot rates instead of contracts based on current market conditions, available capacity, and your service level requirements.

Blue Yonder includes dynamic price discovery for comparing contracted and market rates. Platforms like MercuryGate and Descartes offer similar capabilities, while Cargoson focuses specifically on European market conditions and carrier networks.

Set up automated trigger points within your TMS. When spot rates drop 15% below contract rates for non-urgent shipments, the system can automatically route those shipments to spot carriers while maintaining contracts for time-sensitive deliveries.

The key is integration with your existing ERP systems. Your TMS needs visibility into order priorities, inventory levels, and customer service requirements to make optimal routing decisions. SAP Transportation Management, Oracle TM, and Cargoson all offer strong ERP integration capabilities.

Risk Management Through Diversified Procurement Approaches

Risk management in transportation procurement extends beyond just rate volatility. The driver shortage crisis with 426,000 unfilled positions affects capacity and costs, creating service reliability risks that pure spot rate strategies can't address.

Regulatory compliance adds another risk layer. The Eurovignette Directive will implement additional road tolls based on CO2 emissions, and ETS II begins in 2027, potentially disrupting existing rate structures. Contract rates that include compliance cost escalation clauses provide protection against regulatory surprises.

Your risk mitigation framework should include carrier financial stability monitoring. Contract carriers provide more transparency into their financial health compared to spot carriers sourced through digital marketplaces. Platforms like Transporeon and Cargoson offer carrier scoring that includes financial stability metrics.

Currency risk becomes significant for cross-border movements. Euro-denominated contracts provide currency stability for shipments between Eurozone countries, while GBP or CHF spot rates can create budget volatility. Build currency hedging strategies into your procurement approach.

Service level diversification matters too. Use contracts for your most critical shipments where service reliability outweighs cost savings. Reserve spot rates for shipments where you can absorb potential delays without operational impact.

Practical Implementation: Building Your 2025 Procurement Strategy

Start by analyzing your current contract portfolio. Calculate the effective cost per shipment including fuel surcharges, accessorial fees, and administrative overhead. Many companies discover their "competitive" contract rates actually cost 15-20% more than the base rate when all fees are included.

Map your shipping patterns against market volatility. Routes with high seasonal variance benefit from higher spot rate percentages during off-peak periods. Stable, year-round lanes should maintain higher contract percentages for capacity security.

Leading companies achieve 4-6 week cycles for complex multi-modal tenders, compared to 8-12 weeks with manual processes. Use this benchmarking data to evaluate your current procurement efficiency and set improvement targets.

Implement a phased approach. Start with 20-30% of your volumes in hybrid contract-spot models. A European retail chain achieved 8% total cost savings while improving service quality scores using this gradual implementation strategy.

Your KPI framework needs to balance cost and service metrics. Track total cost of ownership, not just transportation rates. Include administrative costs, service failures, and capacity availability in your calculations. Set up monthly reviews to adjust your contract-spot ratio based on market conditions and performance data.

Technology integration is crucial for execution. Your TMS should provide automated decision-making capabilities that route shipments to optimal carriers based on real-time conditions. Platforms like E2open, Manhattan Active Transportation, and Cargoson offer the sophisticated analytics needed for effective hybrid procurement strategies.

Finally, build strong carrier relationships regardless of contract or spot arrangements. The most successful procurement teams maintain regular communication with both contract and preferred spot carriers. This relationship investment pays dividends during capacity crunches when carriers need to prioritize which customers receive available capacity.