From Guesswork to Growth: How European Shippers Are Using Data Analytics to Transform Transport Procurement and Cut Costs by 15%

That Tuesday morning procurement team meeting just got more expensive. Your transport manager shows slides filled with carrier quotes and spreadsheets, explaining why this quarter's freight costs are 12% higher than expected. Again. The European TMS market is growing at a CAGR of 12.1%, reaching €2.1 billion by 2028 - yet many European shippers are still managing their transport procurement with the same manual processes they used five years ago.

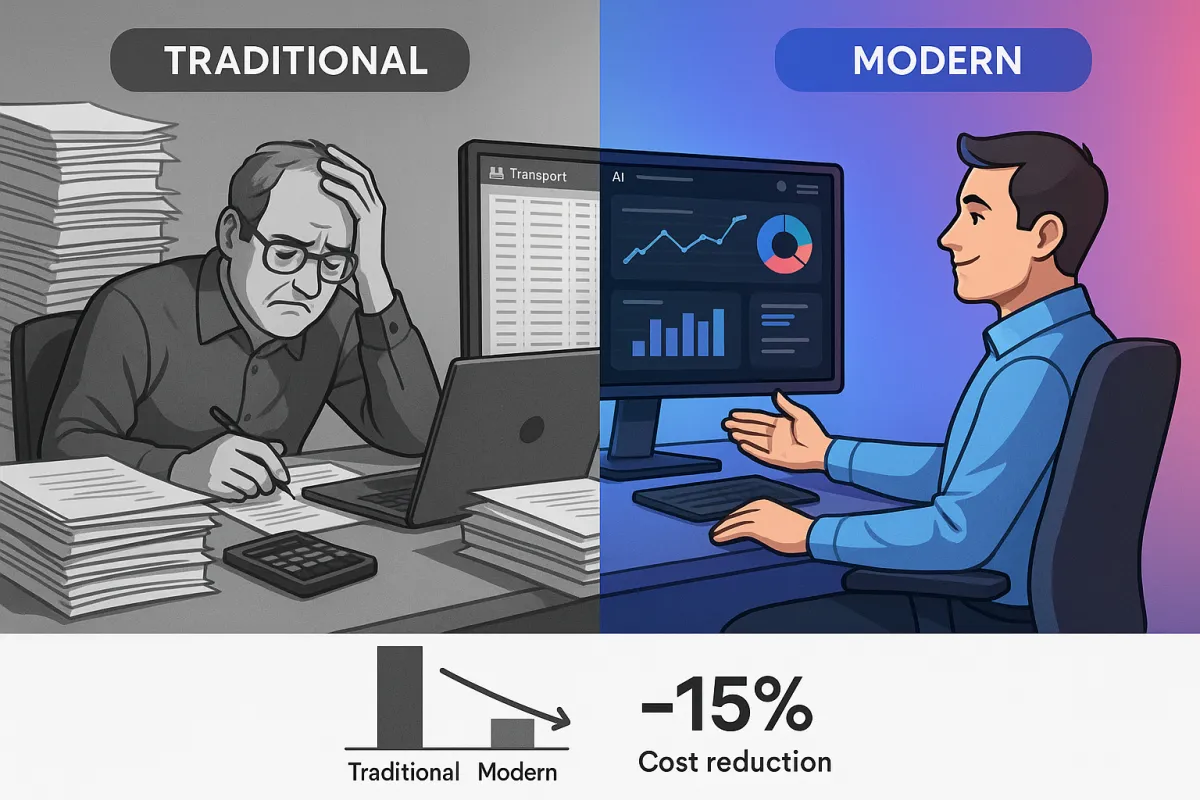

The problem isn't that European manufacturers and retailers lack data. You have plenty. The issue is that the once-traditional freight procurement function faces unprecedented change, requiring businesses to discard clunky manual processes and embrace AI platforms that automate freight procurement workflows. Your procurement decisions need more than historical rate comparisons and gut instincts.

Smart European shippers are already using data-driven transport procurement to cut costs by 15% and transform how they negotiate with carriers. This shift from spreadsheet guesswork to analytics-driven strategy represents the biggest change in transport procurement since the introduction of online tendering platforms.

The Hidden Cost of Spreadsheet-Driven Procurement

Walk into any mid-sized European manufacturer's transport department, and you'll likely find procurement teams spending 3-4 weeks managing a single tender process. They're copying and pasting carrier quotes into Excel, manually comparing rates across different lanes, and trying to remember which carrier performed best on that Frankfurt-to-Milan route six months ago.

57% of supply chain leaders state that hiring and retaining qualified workers is a stiff challenge, with existing workforce drowning under the pressures of labor-intensive day-to-day freight procurement tasks. Your transport manager isn't just managing routes - they're drowning in administrative work that AI could handle in minutes.

The real cost isn't just time. Manual procurement processes lead to reactive decision-making, where you're always responding to rate increases instead of anticipating them. When your biggest carrier announces a 8% rate hike with 30 days notice, you scramble to find alternatives instead of having backup options already evaluated and ready.

Modern solutions from Cargoson, Oracle TM, and SAP offer the data foundation European shippers need, but only when combined with proper analytics capabilities. The gap between having a TMS and using it strategically for procurement decisions remains enormous.

The Analytics Revolution Hitting European Transport Management

The global market for AI in logistics and transportation is projected to grow from $2.1 billion in 2024 to nearly $6.5 billion by 2031, with an annual growth rate surpassing 17%. European companies are collecting contextually rich data - up to 1,000 data elements per shipment record - but most are barely scratching the surface of what this information can reveal about their procurement strategies.

The breakthrough isn't just in data collection. It's in predictive analytics that can forecast rate movements and identify procurement opportunities before your competitors spot them. AI-powered predictive models leverage historical data, real-time market trends, and advanced algorithms to generate cost estimates that improve procurement efficiency, allowing companies to predict the "should-be" cost of a transportation lane.

European logistics leaders are already seeing results. Puma's Global Logistics Procurement team optimized employee working hours by 50% by leveraging AI-powered platforms, freeing up their team to focus on strategic carrier relationships instead of manual rate comparisons.

Established platforms like MercuryGate, Descartes, and emerging solutions like nShift are integrating these analytics capabilities directly into their TMS offerings. The question isn't whether you'll eventually adopt transport procurement analytics - it's whether you'll be early enough to gain competitive advantage.

Essential Data Types European Shippers Must Track

Forget about basic cost-per-kilometer calculations. Effective data-driven transport procurement requires tracking data points most procurement teams ignore.

Historical rate trends need context beyond seasonal fluctuations. Track your rates against specific market events: Brexit-related delays, Suez Canal disruptions, fuel price spikes, and even regional weather patterns. A German automotive supplier discovered their rates increased 15% during specific weeks each quarter - not due to market conditions, but because they were consistently tendering during peak demand windows.

Carrier performance metrics extend far beyond on-time delivery percentages. Track response times to rate requests, accuracy of initial quotes versus final invoices, and performance during peak seasons or disruptions. The carrier offering the lowest rate might cost you more if they consistently underestimate surcharges or deliver late during your critical production windows.

Predictive analytics becomes powerful when you combine your internal data with external market intelligence. AI models analyze vast datasets including weather, geopolitical events, shipping movements, and supplier performance to forecast potential disruptions, allowing companies to proactively adjust routes, inventory, or sourcing. This contextual data transforms simple rate comparisons into strategic procurement intelligence.

Leading European manufacturers are building these datasets systematically, working with TMS providers like Cargoson, E2open/BluJay, and Alpega to create comprehensive procurement analytics foundations.

Building Your Analytics-Driven Procurement Framework

Start with procurement cycle measurement. Leading companies complete their tender processes in 4-6 weeks, while manual-heavy organizations take 8-12 weeks. The difference isn't just efficiency - longer cycles mean you're making decisions on stale market data.

Advanced optimization engines can automatically compare and evaluate logistics service providers at scale to find the ideal combination of cheapest, fastest, or greenest options, running complex procurement analysis in real-time with little to no human intervention. This isn't about replacing your procurement team - it's about giving them superpowers.

Your implementation should focus on total cost of ownership, not just operational efficiency. AI-driven insights empower procurement teams to secure fair pricing, avoid overpayment, and negotiate competitive contracts, while providing managers with clear data to oversee and optimize cost structures. The goal is 10-15% additional savings through better decision-making, not just faster spreadsheet calculations.

Modern TMS platforms - whether you choose Cargoson, Transporeon, or established solutions like SAP TM - can provide the data foundation. The key is ensuring your chosen platform can export procurement analytics, not just operational reports. Look for solutions that offer API access to your procurement data for further analysis.

ROI measurement must extend beyond immediate cost savings. Track your procurement team's time allocation - are they spending more hours on strategic carrier relationships and less on data entry? Measure your ability to respond to market changes and capitalize on rate opportunities your competitors miss.

Overcoming Common Analytics Implementation Challenges

Data quality issues between your TMS and existing ERP systems create the biggest implementation headaches. European companies often struggle with inconsistent location codes, varying measurement units across countries, and different carrier naming conventions. Thorough integration testing isn't optional - it's the difference between useful analytics and garbage output.

Change management for procurement teams requires careful attention. Your transport manager who's been successfully negotiating rates for 15 years might view AI recommendations as questioning their expertise. Position analytics as enhancement, not replacement. Show how predictive insights can validate their instincts and provide ammunition for carrier negotiations.

Digital freight procurement platforms automate routine tasks from tender creation to rate comparison, freeing up employees to focus on work that requires greater creative, strategic, and empathetic execution. The transition means shifting your team from transactional duties to strategic functions - a change that requires training and patience.

Integration complexity varies significantly across TMS providers. Cloud-based solutions typically offer easier integration, while on-premise systems might require more technical resources. Work with your IT team to establish clear data governance policies before implementing analytics capabilities.

Measuring Success: KPIs That Matter for European Shippers

Procurement cycle time from tender launch to contract execution serves as your primary efficiency metric. Leading European companies achieve 4-6 week cycles, while manual processes stretch to 8-12 weeks. Faster cycles mean fresher market data and quicker responses to rate opportunities.

Cost optimization metrics should focus on total cost of ownership improvements. One European retailer achieved 8% total cost savings while improving service quality by using analytics to identify carriers that consistently delivered accurate quotes and reliable service. The lowest-bid carrier often wasn't the best total value.

Carrier participation rates indicate procurement process health. If your tender participation drops below 70%, you're either requesting too much data, taking too long to award contracts, or working with carriers who don't value your business. TMS analytics can help identify which process improvements increase carrier engagement.

Network diversity metrics matter for risk management. Measure your dependency on single carriers or regions. AI improves forecasting accuracy by up to 98%, reducing supply chain errors by 50%, but only if your procurement strategy maintains sufficient carrier alternatives to capitalize on these insights.

Financial impact measurement should include both direct savings and avoided costs. Track how often your analytics identify rate increases before they're implemented, allowing proactive mitigation rather than reactive scrambling.

Future-Proofing Your Procurement Strategy for 2026 and Beyond

By 2025, 68% of logistics enterprises are expected to experiment with AI applications, up from 48% in 2022. AI-powered predictive analytics is becoming table stakes for transport procurement, not a competitive advantage.

Sustainability considerations and regulatory compliance automation will reshape European transport procurement significantly. New regulations around emissions reporting and carbon tracking require procurement decisions that balance cost, service, and environmental impact. Manual processes can't handle this complexity effectively.

AI-optimized routing can lower fuel consumption by over 15% annually, but procurement strategies must evolve to evaluate carriers based on sustainability metrics alongside traditional cost and service measures. The winning procurement approach will automatically incorporate emissions data into carrier comparisons.

Machine learning algorithms are moving beyond cost optimization toward comprehensive risk management, predicting non-compliant patterns and supply chain anomalies within specific routes or lanes, detecting freight transport issues in real-time and executing remedial measures. Your procurement strategy needs to anticipate and adapt to these capabilities.

Forward-thinking platforms including Cargoson alongside Uber Freight, FreightPOP, and Shiptify are already building these next-generation capabilities. The companies that start building analytics-driven procurement capabilities now will be positioned to leverage whatever innovations emerge in the next 18 months.

Your transport budget for 2026 depends on decisions you make today about procurement analytics adoption. The spreadsheet-driven approach that worked when fuel was cheaper and capacity was abundant won't survive in an environment where 1-2% margin improvements determine competitiveness. The data is there. The tools are available. The question is whether you'll use them before your competitors do.