The 49.77 Million Device Challenge: How European Shippers Can Master TMS-Telematics Integration Before Implementation Costs Spiral Out of Control

The Europe Telematics Market size is estimated at 24.49 million units in 2025, and is expected to reach 49.77 million units by 2030, marking the most significant data explosion European shippers have faced. Yet while most European transport managers are scrambling to understand this growth, they're missing the bigger picture: The number of active telematics devices in Europe is expected to reach 49.77 million by 2026 – growth that reflects not a trend but a structural shift. Yet this massive data explosion creates an implementation nightmare most European shippers haven't properly budgeted for.

The regulatory drivers make this transformation unavoidable. The forthcoming Euro 6e-bis emissions standard and the fitment of smart tachograph Gen2V2 (by July 2026) ensure all commercial vehicles will carry advanced telematics. Add mandatory eFTI compliance by July 2027 and you're looking at a perfect storm of requirements that will force every European shipper to integrate telematics data with their transport management systems.

Here's what's catching most procurement teams off guard: Budget overruns hit 75% of European TMS implementations, yet most shippers focus only on subscription costs when evaluating systems. Implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee.

The Hidden Cost Reality Most Shippers Miss

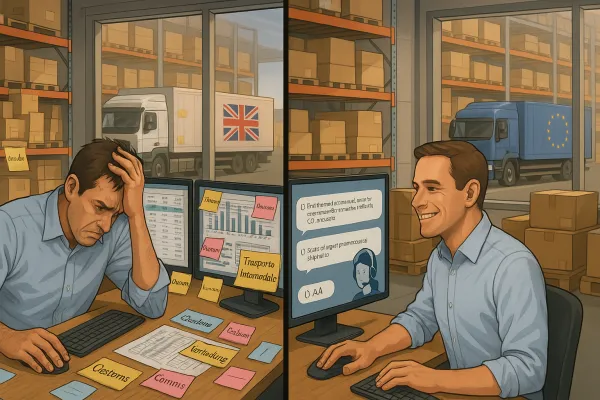

Remember that German automotive parts manufacturer we mentioned? A mid-sized German automotive parts manufacturer thought their TMS implementation was going smoothly. Six months in, €800,000 spent, and they realized their new system couldn't handle their complex carrier network across 12 countries. Their mistake wasn't technical - it was underestimating the complexity of European telematics integration.

A basic domestic shipper needs 10-15 integrations minimum, totaling 1,000-1,500 hours of labor, while most shippers today require an average of 40 integrations. Some complex implementations record over 140 integration objects. When you're dealing with telematics data from multiple device vendors across different countries, each requiring real-time processing and validation, these numbers multiply quickly.

The financial reality becomes clearer when you break down actual costs. Hidden costs in TMS procurement consistently add 25-30% more than initial estimates, turning what looked like smart investments into budget disasters. For a European manufacturer managing transport across 12 countries with mixed fleet operations, you're looking at integration costs that typically exceed initial software licensing by 200-300%.

Licensed TMS models include annual maintenance charges ranging from 15-20% of license costs, while traditional software maintenance fees often run around 20% of the license fee annually for support and minor upgrades. Oracle TM and SAP TM exemplify this pricing complexity through multi-layered fee structures that include base licenses, user counts, transaction volumes, and regional modules.

Why Traditional Integration Approaches Fail in Europe

European transport operations face challenges that simply don't exist in single-market implementations. Implementing a TMS in Germany is different from implementing one in Germany, France, Poland, and the Netherlands simultaneously. European shippers don't just need software that works—they need systems that handle 27 different VAT rates, multiple languages, varying carrier integration protocols, and soon, eFTI regulation compliance.

The interdependency becomes clear when you examine how telematics data must flow through your systems. Telematics systems integrated with your TMS system provide live positions, DTCO data, temperature readings for refrigerated loads, and eco-driving insights. Dispatchers see realistic ETAs and receive alerts before a driver hours-of-service conflict causes a missed slot. This isn't just about tracking trucks - it's about ensuring compliance across different national regulations while maintaining real-time visibility.

Cost competitiveness now requires full digitization. European shippers managing cross-border operations can't optimize routes, manage carrier performance, or provide accurate delivery windows without integrated telematics data. ESG reporting demands become impossible to meet without digital systems that automatically capture emissions data by route and mode.

Consider the complexity when your operations span multiple countries: German carriers use different EDI standards than French ones, Polish documentation requirements differ from Dutch customs processes, and Italian last-mile providers may still rely on fax communication. A Dutch food distributor selected Oracle Transportation Management based on its North American success stories. They discovered too late that their system couldn't handle the different EDI standards used by German carriers versus French ones.

The Strategic TMS-Telematics Integration Framework

Phase 1 - Data Architecture Planning

Before selecting any vendor, map your telematics data requirements across your entire operation. Your integration must handle seamless connection among TMS, WMS, ERP systems, and external data sources while maintaining proper data governance across different regulatory frameworks.

Start with data flow mapping. These features provide real-time visibility into shipment status. Using GPS technology, telematics devices, and electronic logging devices, these systems monitor vehicle locations and movements throughout the journey. RFID and barcode scanning capture detailed information as freight moves through cross-docks and distribution centers.

Define data quality standards that account for European complexity. German tachograph data has different validation requirements than French driver hour regulations. Your framework must establish consistent data formats while accommodating country-specific variations. Temperature monitoring for pharmaceuticals requires GDP compliance in addition to standard tracking capabilities.

Build validation rules for cross-border operations. When a truck crosses from Germany into Poland, your system needs to automatically switch compliance monitoring while maintaining consistent operational visibility. This means validating driver qualifications, vehicle permits, cargo documentation, and customs requirements in real-time.

Phase 2 - Platform Selection and Vendor Evaluation

European-built solutions understand these cross-border complexities from the ground up, enabling faster implementation and better carrier integration. Compare integration ecosystems carefully: established platforms like Project44 offer 1,400+ telematics integrations, while Shippeo integrates with 1,000+ TMS/telematics/ELD systems. These numbers matter, but European connectivity matters more.

When evaluating vendors, consider Cargoson alongside traditional providers like MercuryGate, Descartes, and nShift. Solutions like Cargoson focus on European manufacturers, wholesalers, and retailers with direct API/EDI integrations across all transport modes, specifically addressing challenges that manufacturing, wholesale, and retail companies face.

Evaluation criteria should include high-volume data processing capabilities. When you're managing 49.77 million telematics touchpoints generating real-time updates, your platform needs cloud-native architecture designed for European-scale operations. Traditional on-premise solutions simply can't handle this data volume cost-effectively.

Look for vendors offering pre-built integrations with European telematics providers like Geotab, Samsara, and idem telematics. While many TMS solutions offer published APIs, carriers are often unwilling or unable to create connections themselves, and even when they can, they typically charge integration costs back to the shipper. Transporeon and nShift require carriers to implement standard EDI interfaces themselves, while Cargoson builds true API/EDI connections with carriers rather than requiring standardized EDI messages that carriers must implement.

Phase 3 - Implementation and Testing Strategy

Follow a proven phased approach that reflects European transport reality. Deploy core TMS functionality first with limited telematics integration, focusing on data quality and user training. Only after achieving operational stability should you enable advanced telematics features like predictive analytics and automated exception management.

Cloud TMS implementations often conclude within eight weeks, compared to 6-18 months for traditional systems. This speed difference matters when European transport regulations change frequently or when expanding into new markets.

Risk mitigation requires comprehensive testing across your entire carrier network. Test data flows with your largest carriers first, then expand to regional providers. Each integration point needs validation under different scenarios: cross-border shipments, multi-modal transport, exception handling, and compliance reporting.

Performance benchmarking should establish baseline metrics before telematics integration. Measure current manual processes, documentation accuracy, and compliance costs. These tools help identify opportunities for improvement, measure the impact of process changes, and quantify the TMS implementation value.

Regulatory Compliance as Integration Driver

eFTI compliance creates a hard deadline that makes telematics integration mandatory, not optional. As of 9 July 2027: The eFTI Regulation will apply in full. Member State authorities must accept information shared electronically by operators via certified eFTI platforms.

The timeline provides an 18-month implementation window, but procurement and integration typically require 12-15 months for complex European operations. Member State authorities must accept electronic information via certified eFTI platforms starting July 9, 2027. This isn't optional - it's mandatory for freight operators wanting to avoid paper documentation burdens during inspections. Your TMS selection directly impacts eFTI readiness.

CO₂-based fees for truck journeys launch in 2026, making emissions tracking an operational cost driver requiring modernized fleets with integrated telematics. The EU targets ~55% CO₂ reduction by 2030, making fleet optimization and EV integration mandatory for operators. This creates direct financial incentive for telematics integration beyond compliance requirements.

The European Commission estimates eFTI could save the EU transport and logistics sector up to €1 billion per year. But only if your systems can actually support the digital transformation. Companies with integrated TMS-telematics platforms will capture disproportionate savings while competitors struggle with manual compliance processes.

ROI Measurement and Success Metrics

Quantifying telematics integration benefits requires measuring both operational improvements and compliance cost avoidance. A European manufacturer with €2M annual transport spend invests €200K in a TMS implementation. The annual gains break down to: €85K in fuel savings through route optimization (4.25% of transport spend) €120K in productivity gains from automated planning (equivalent to 1.5 FTE transport coordinators) €25K in dispute reduction through improved documentation. A well-optimized TMS typically generates 15 to 25% kilometer savings, but these gains can vary from 5% on already well-optimized routes to 40% on historically poorly planned routes.

Success metrics should account for European-specific benefits. Cross-border documentation accuracy improvements reduce customs delays by 15-20%. Automated compliance reporting eliminates manual audit preparation costs averaging €50,000-75,000 annually for mid-sized operations.

Case studies demonstrate measurable results. Romanian operator Altec Logistic increased revenue 41.7% and doubled net profit through integrated telematics, automation, and emissions monitoring. Their success came from treating telematics data as strategic business intelligence rather than simple vehicle tracking.

Framework for measuring integration ROI should include: reduced manual processes (typically 60-70% reduction in transport coordination time), improved carrier performance (15-20% improvement in on-time delivery), decreased exceptions handling (30-40% reduction in shipment issues), and compliance cost avoidance (estimated €25,000-50,000 annually per regulatory framework).

The European shippers who succeed with TMS-telematics integration are those who plan for complexity, budget realistically, and choose platforms built for European transport operations. The 24% who succeed follow proven methodologies, plan for hidden costs, and choose platforms built for European compliance requirements. The 76% who struggle skip the planning, underestimate the complexity, and treat their TMS like a simple software purchase rather than a strategic transformation.

Your telematics integration decision affects the next five years of transport operations. Make it with full understanding of the costs, complexity, and competitive advantages at stake. The 49.77 million device challenge isn't going away - but with proper planning and the right platform, it becomes your operational advantage.