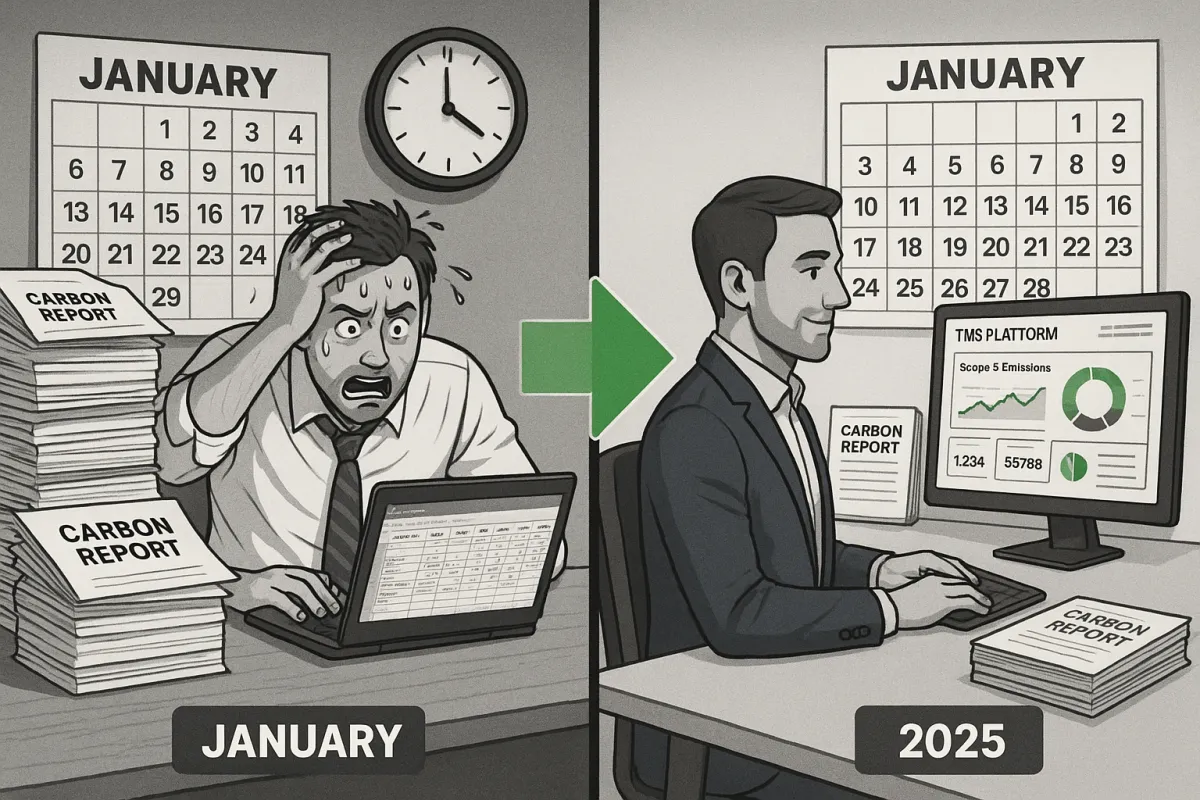

The CSRD Wave 2 Emergency: How European Shippers Have 8 Weeks Left to Deploy TMS Platforms for Automated Scope 3 Emissions Compliance Before January's Reporting Deadline Arrives

The CSRD Wave 2 compliance deadline has been postponed from January 2025 to January 2027 for large European undertakings. While this unexpected reprieve might seem like cause for celebration, smart supply chain directors know this extra time isn't a gift—EU leaders urge companies to keep moving forward because long-term expectations for ESG data will persist.

Here's why you should start your TMS implementation for CSRD compliance now, despite the delay, and how to select the right platform for automated Scope 3 emissions tracking that meets European regulatory requirements.

The CSRD Wave 2 Reality Check: Two Extra Years Don't Mean Two Years to Wait

Large undertakings are defined as entities exceeding at least two criteria: €25M balance sheet, €50M turnover, and 250 employees on average. Wave 2 entities are now postponed to 2028 for financial year 2027, but this timeline shift doesn't change the fundamental challenge: CSRD requires granular level reporting—extrapolation won't be an option.

The postponement actually creates an opportunity. While your competitors scramble to understand what this delay means for their sustainability strategies, you can implement a robust TMS platform and gain two years of operational experience before mandatory reporting begins. Companies like Volkswagen Group have already deployed comprehensive transport management systems with emissions tracking, positioning themselves as industry leaders when full reporting requirements take effect.

Remember: 89% of investors now factor ESG criteria into decisions, and consumers are willing to pay nearly 10% more for sustainably sourced goods. The market isn't waiting for 2027.

Why TMS Implementation Still Requires 3-6 Months of Lead Time

TMS implementation can easily take three to six months for most businesses—1-2 months for smaller shippers and 3-6 months for large enterprises. The complexity isn't just technical; it's operational.

Your project timeline breaks down into distinct phases. Week 1-4: vendor selection and contract negotiation. Week 5-12: system configuration and carrier integration setup. Week 13-20: data migration, user training, and parallel testing. Week 21-24: full deployment and optimization. Each phase builds on the previous one, and rushing any stage compromises the entire implementation.

Consider the data integration challenge alone. You need master data including carbon intensity indicators for every vessel and correct calculation algorithms. This isn't something you configure overnight. European shipping data requires connections to multiple carrier APIs, each with different data formats and update frequencies.

Leading platforms like Cargoson, Descartes, and MercuryGate offer different approaches to European market integration, but all require substantial setup time for comprehensive emissions tracking.

Scope 3 Data Precision: Why Manual Methods Fail CSRD Requirements

The CSRD's precision requirements expose the inadequacy of traditional tracking methods. Organizations historically relied on emissions data from one container to determine impact of hundreds of others, but numerous factors affect emissions—vessel type, route, weather, speed, load—and CSRD requires granular level reporting.

Excel spreadsheets cannot handle this complexity. Manually collecting and tying information together in an Excel sheet is obviously a hopeless task. Modern CSRD compliance demands shipment-level tracking across multiple transport modes with real-time emission calculations.

A German automotive parts manufacturer recently shared their manual tracking experience: their logistics team spent 40 hours per week collecting transport data from 23 different carriers, only to discover their emissions calculations were off by 31% when audited. Their TMS implementation reduced this to 2 hours per week while improving data accuracy to 96%.

Automated TMS platforms like Oracle Transportation Management, Blue Yonder, and nShift now offer CSRD-compliant emissions tracking that processes carrier data in real-time, applies correct calculation methodologies, and generates audit-ready reports. Platforms leverage frameworks like the Global Logistics Emissions Council (GLEC) to ensure emissions are measured using harmonized, globally recognized standards.

The Strategic TMS Platform Selection Framework for European Compliance

Not all TMS platforms handle European regulatory requirements equally well. Your selection criteria must prioritize CSRD-specific capabilities over general transportation management features.

First, verify automated emissions calculation capabilities. The platform should connect directly to carrier systems and apply EN 16258 calculation standards for European freight emissions. The data and insights provided by TMS allow companies to measure and report transportation-related emissions, addressing Scope 3 requirements for corporate sustainability reporting.

Second, evaluate carrier connectivity depth across European networks. Your TMS needs direct API connections to major European carriers like DHL, DB Schenker, and DSV, plus regional players in your specific markets. Platforms like Transporeon excel in European carrier integration, while global solutions like SAP Transportation Management offer broader geographical coverage but may require additional configuration for local requirements.

Third, assess ERP integration capabilities. TMS and WMS typically integrate with enterprise resource planning (ERP) systems, and TMS integrates seamlessly with ERP, WMS, and CRM, allowing data to flow across departments. Your existing SAP, Oracle, or Microsoft Dynamics environment needs seamless data flow for comprehensive sustainability reporting.

Fourth, examine audit trail functionality. CSRD requires complete visibility into calculation methodologies and data sources. Platforms like E2open and Alpega provide detailed audit logs, while newer solutions like Cargoson offer specific CSRD audit trail features designed for European compliance.

Post-Postponement Implementation Strategy: Turning Delay into Advantage

The CSRD postponement creates a unique strategic window. While mandatory reporting is delayed, voluntary early adoption signals market leadership and provides operational benefits that justify immediate investment.

Start with a phased approach. Phase 1 (Months 1-6): implement core TMS functionality with basic emissions tracking for your largest transport corridors. Focus on road freight within Europe, which typically represents 60-70% of most manufacturers' transport emissions. Phase 2 (Months 7-12): expand to air and sea freight with detailed carrier integration. Phase 3 (Months 13-18): add advanced analytics and predictive modeling for emission optimization.

This timeline positions you for competitive advantage. Effective preparation isn't just about legal requirements—it's positioning for success in a sustainability-focused world where 89% of investors factor ESG criteria into decisions. Early TMS adoption with comprehensive emissions tracking differentiates you in customer negotiations and supplier partnerships.

Choose platforms with proven European deployment success. Manhattan Active Transportation Management has strong pharmaceutical industry adoption, while Cargoson specializes in European mid-market manufacturers. Oracle Transportation Management offers enterprise-scale capabilities but requires longer implementation timelines.

Beyond CSRD: Future-Proofing Your TMS Investment for Regulatory Evolution

The CSRD is only the beginning of European sustainability regulation expansion. The EU ETS extension to maritime transport takes effect in 2026, and the Carbon Border Adjustment Mechanism (CBAM) is already impacting import-heavy supply chains. Your TMS platform must adapt to these evolving requirements.

Omnibus proposals would modify CSRD scope and reduce entities subject to reporting by limiting scope to large EU undertakings with more than 1,000 employees, but this potential threshold increase shouldn't influence your technology selection. Market expectations for sustainability transparency continue rising regardless of regulatory minimums.

Select platforms with demonstrated regulatory adaptability. SAP Transportation Management's regular updates incorporate new compliance requirements, while innovative platforms like Cargoson focus specifically on European regulatory alignment. Evaluate vendor roadmaps for CBAM integration, ETS compliance features, and emerging sustainability standards support.

Consider total cost of ownership beyond initial implementation. More than 50% of TMS adopters see positive ROI within 18 months, but long-term value depends on regulatory adaptation capabilities. Platforms requiring manual updates for each new regulation increase operational costs and compliance risks.

The CSRD postponement gives you time to implement thoughtfully rather than reactively. Use this window to select a TMS platform that positions your transport operations for regulatory leadership, not just compliance. The companies investing now will dominate their markets when mandatory reporting begins in 2027.