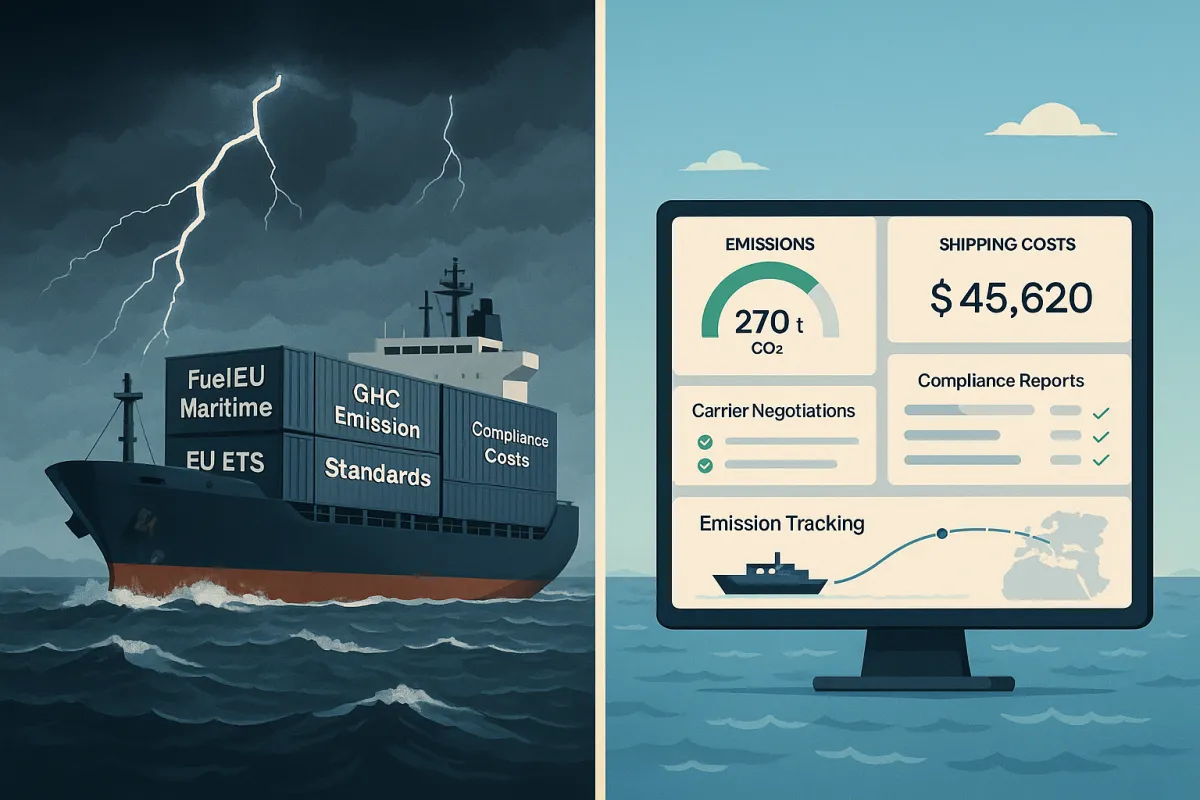

The EU ETS Cost Crisis: How Smart European Shippers Are Using Modern TMS Platforms to Turn 2025's Regulatory Storm into Strategic Advantage

The EU ETS shipping costs for 2025 will hit European shippers harder than most expected, with coverage jumping to 70% of emissions from just 40% in 2024. Carriers warn their ETS surcharges could nearly double under the updated regulations, and higher increases are anticipated in 2025 and 2026 due to the phase-in approach, with costs generally passed on to shippers by shipping companies.

Here's what makes 2025 different: EUA prices peaked at €142 in January 2025, driven by market speculation and initial demand surges, though they've since stabilized. One study estimates that a container ship emitting 16,000 tCO2e per year would generate €1.66 million in EU ETS costs in 2027. Industry representatives like Maersk, Hapag-Lloyd and CMA CGM foresee increases of €7 to €105 per TEU after the EU ETS expansion.

European manufacturers are feeling the squeeze. The ETS extension increases total shipping costs by 3.7% on average in 2024, with the percentage rising alongside coverage. ETS surcharges imposed by shipping companies in 2024 represent freight rate increases between 1% and 5% for deep sea container services and between 3% and 11% for various ferry lines.

Beyond Maritime: The Multi-Modal Compliance Challenge European Shippers Face

Starting in 2025, general cargo ships of 400 gross tonnage or more are now required to comply with MRV reporting obligations, expanding the scope of the EU's decarbonization framework. Starting from January 1, 2026, ETS regulations will expand to include emissions of two additional greenhouse gases: nitrous oxide and methane.

The regulatory complexity doesn't stop at maritime. FuelEU Maritime regulations require carriers to adopt sustainable fuels with the goal of reducing GHG intensity by 2% in 2025 compared to 2020 levels, with non-compliance penalties of €2,400 per metric ton of fuel that fails to meet standards.

New compliance penalties include late-filing fees of €50/day for overdue emissions reports, and verification procedures now include stricter audit thresholds and document authentication requirements. According to Regulation (EU) 2023/957, shipping companies face substantial penalties of €100 per excess ton of CO₂ emitted for non-compliance.

European shippers need visibility across all transport modes as compliance becomes table stakes. The challenge isn't just tracking emissions - it's verifying that carriers aren't overcharging for compliance costs.

The Hidden Opportunity: How Leading European Manufacturers Are Converting Compliance Costs into Competitive Intelligence

Smart European shippers are turning regulatory pressure into procurement power. The European TMS market reached around €1.2 billion in 2023 and is forecasted to grow at a CAGR of 12.1% to reach €2.1 billion in 2028. This growth reflects companies investing in systems that don't just track compliance - they optimize it.

Consider this scenario: You're managing logistics for a manufacturing company with €50 million in annual transport spend. Without proper emissions tracking, you're at the mercy of carrier surcharge calculations. With modern TMS platforms providing real-time emissions data, you can verify actual versus charged ETS costs and identify discrepancies.

One European manufacturer discovered their carrier was overcharging by 15% on ETS surcharges across Mediterranean routes. The annual savings from catching this exceeded €180,000 - more than enough to justify their TMS investment.

Real-Time Emissions Monitoring and Cost Verification

Modern transportation management systems excel at connecting emissions data with financial impact. Platforms like Cargoson, alongside solutions from Oracle TM, Descartes, and SAP, now provide API integrations that pull real-time emissions data directly from carriers' MRV systems.

The advantage goes beyond cost verification. You can use accurate emissions data during carrier negotiations, comparing not just rates but total cost of ownership including ETS surcharges. This transparency shifts power back to shippers who previously had limited visibility into compliance costs.

The TMS Selection Framework for EU ETS Readiness

Not all TMS platforms handle EU ETS compliance equally. When evaluating transportation management system compliance solutions, European shippers need specific capabilities:

Multi-carrier emissions integration: Your TMS should pull emissions data from multiple carriers through standardized APIs. Manual data entry defeats the purpose of automation and creates verification gaps.

Automated compliance reporting: Look for systems that generate ETS compliance reports automatically, matching shipment data with emissions calculations. This becomes critical as scope expands to include offshore ships and general cargo vessels.

Rate comparison with embedded emissions costs: Advanced platforms compare total transport costs including estimated ETS surcharges, not just base rates. This prevents the common mistake of choosing seemingly cheaper carriers who later apply hefty emissions fees.

Dispute management tools: When carriers overcharge on ETS costs, you need documentation and workflows to challenge incorrect surcharges. The best TMS solutions include built-in dispute tracking.

European shippers have options across the spectrum. Enterprise solutions like Manhattan Active and Blue Yonder offer comprehensive functionality for large operations. Mid-market platforms including MercuryGate, Transporeon, and nShift provide strong European coverage. Cloud-native solutions like Cargoson focus on rapid implementation for companies needing ETS readiness quickly.

Strategic Implementation: The 90-Day Roadmap to ETS-Ready Transport Management

Time matters when shipping companies must surrender their first ETS allowances by 30 September 2025 for emissions reported in 2024. Here's a practical implementation roadmap:

Days 1-30: Baseline and Requirements

Document current emissions tracking capabilities across all carriers. Identify data gaps and establish baseline transport emissions for 2024. Most importantly, review existing carrier contracts for ETS surcharge terms and dispute resolution clauses.

Days 31-60: TMS Selection and Setup

Focus on solutions with proven EU compliance features. Cloud-based platforms typically deploy faster than on-premise systems - critical when regulatory deadlines loom. Ensure your chosen platform integrates with existing ERP systems and provides the carrier network coverage you need.

Days 61-90: Integration and Validation

Connect carrier emissions feeds and validate data accuracy against known shipments. Train procurement teams on using emissions data for negotiations and establish workflows for challenging incorrect surcharges.

The goal isn't perfection by day 90 - it's operational readiness. European manufacturers implementing this timeline typically see 15-20% better visibility into transport costs and identify 8-12% in potential savings from improved carrier negotiations.

Looking Beyond 2026: Future-Proofing Transport Operations for Full ETS Coverage

From 2026 onwards, companies must submit allowances for all their verified emissions. This full coverage, combined with the inclusion of nitrous oxide and methane emissions, will significantly increase compliance complexity and costs.

The International Maritime Organization is also looking at introducing a global carbon pricing mechanism to be adopted by 2025 and come into force by 2027, with the EU reportedly agreeing to join this global mechanism. European shippers need platforms that can adapt to changing regulatory landscapes.

Transport management platforms are evolving to meet these challenges. Solutions from established players like Blue Yonder and SAP TM are adding predictive analytics for emissions forecasting. Newer platforms like Cargoson focus on agility and rapid compliance updates. The key is choosing systems built for change, not just current requirements.

Annual costs for shippers could reach €10 billion once the scheme covers all emissions. Companies with robust TMS platforms will have the visibility and control needed to manage these costs effectively.

Action Plan: Your Next Steps to Turn Regulatory Pressure into Procurement Power

European shippers can't avoid EU ETS costs, but they can control them. Start by auditing your current emissions tracking capabilities - most companies discover significant gaps that carriers exploit through inflated surcharges.

When evaluating freight management software, prioritize European market focus and proven compliance features over generic functionality. The regulatory landscape changes too quickly for platforms that treat compliance as an afterthought.

Most importantly, view your TMS investment as procurement intelligence, not just operational efficiency. The companies gaining competitive advantage from 2025's regulations are those using better data to drive better negotiations. With the North American TMS market forecasted to reach almost €2.7 billion in 2028 and European markets growing at similar rates, the window for competitive advantage through superior transport technology is closing.

The regulatory storm of 2025 isn't going away. European manufacturers who implement modern TMS platforms now will navigate it successfully while competitors struggle with compliance costs they can't control or verify. The choice is simple: lead with technology or get left behind by regulations.