The European Shipper's Acquisition-Resistant TMS Vendor Selection Framework: How to Build Due Diligence Criteria That Protect Against Integration Failures When 66% of Technology Projects End in Disaster

A German automotive parts manufacturer discovered this the expensive way. After selecting their TMS based on a feature comparison spreadsheet, they faced €800,000 in additional costs when carrier integration failures emerged post-acquisition of their chosen vendor. According to the Standish Group's CHAOS 2020 report, 66% of technology projects end in partial or total failure, with McKinsey research showing that 17% of large IT projects threaten the very existence of the company. With WiseTech Global's $2.1 billion acquisition of E2open and Descartes Systems Group's $115 million purchase of 3GTMS in March 2025, European procurement teams face urgent pressure to build TMS vendor selection criteria that protect against the growing risks of market consolidation.

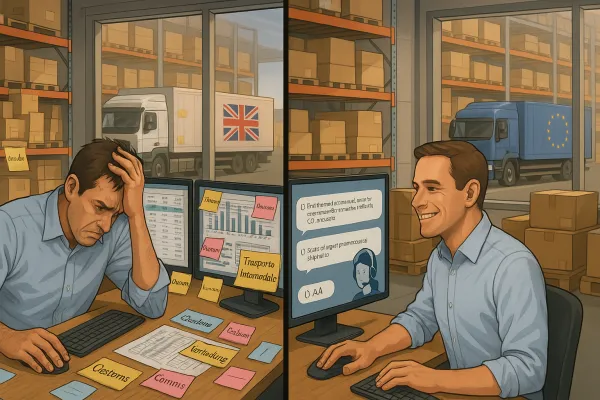

The €800,000 Reality Check: Why Traditional TMS Vendor Selection Is Failing in 2026's Consolidation Wave

Traditional TMS vendor selection processes focus on feature checklists and pricing comparisons. You compare transportation management systems based on route optimization algorithms, carrier connectivity counts, and user interface screenshots. This approach misses the fundamental risk reshaping the industry: vendor consolidation is accelerating faster than most European procurement teams can adapt their due diligence processes.

The consolidation of two major players like WiseTech and e2open positions platforms to serve both service providers and shippers in a unified ecosystem, but this acquisition fits a pattern of ongoing investment and ownership changes in the logtech market, making the global supply chain software landscape significantly more consolidated. When your TMS vendor becomes an acquisition target, you inherit integration complexity without managing the project timeline.

The Three Hidden Risks Traditional Procurement Teams Miss

First, you lose control over technology roadmaps. For current e2open customers, the key question is whether WiseTech can maintain product investment and innovation while managing complex integration, with the main concern being whether innovation and product investment will be maintained during integration. Your feature requests get deprioritized as the new parent company focuses on platform consolidation rather than customer-specific enhancements.

Second, integration with existing systems becomes unpredictable. Legacy platforms often lack modern APIs necessary for automated data exchange. When vendors merge development teams and consolidate platforms, your carefully planned ERP integrations face unexpected technical hurdles.

Third, fragmented due diligence creates risky information gaps. Most procurement processes rely on vendor-provided financial statements and reference customers. But acquisition activity happens faster than annual reports, and reference customers may not reveal integration challenges until months after go-live.

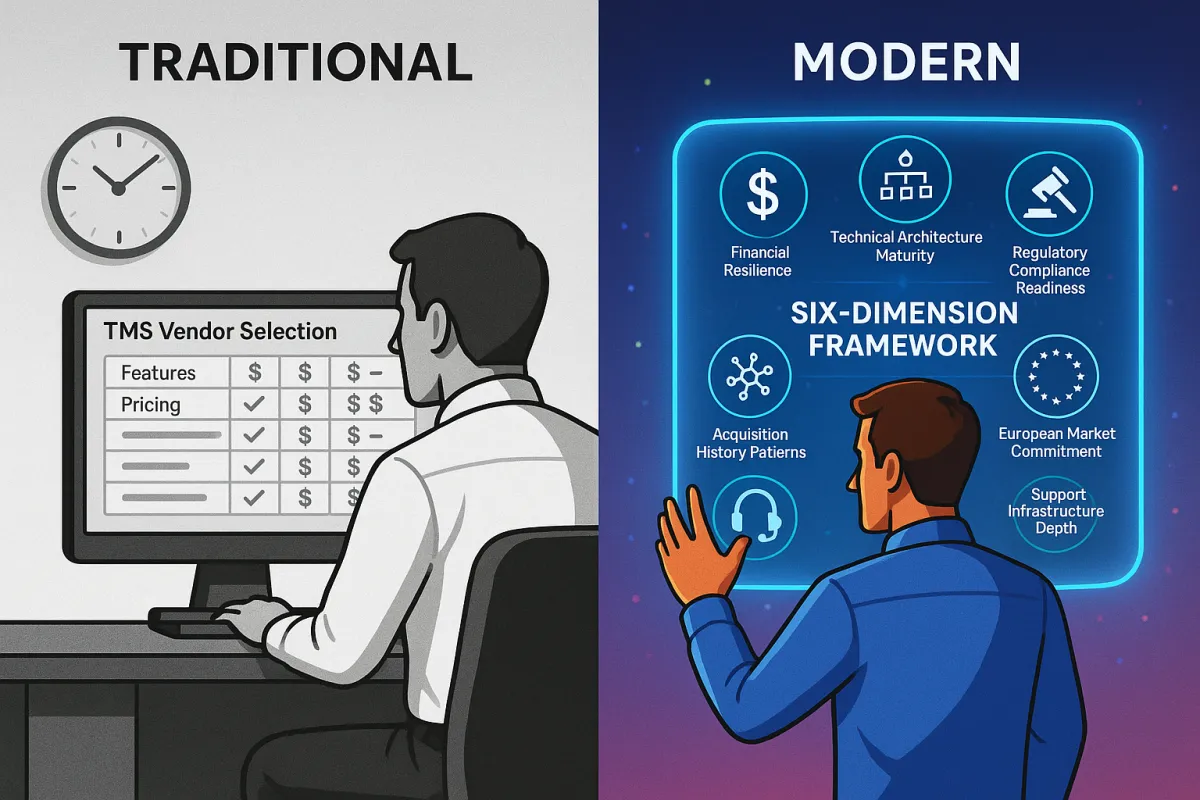

Building Your Acquisition-Resistant Vendor Assessment Matrix

Replace feature-based scoring with a six-dimension framework that evaluates vendor stability beyond quarterly earnings reports. This approach assesses financial resilience, technical architecture maturity, regulatory compliance readiness, acquisition history patterns, European market commitment, and support infrastructure depth.

Your assessment matrix should weight these factors based on your specific risk tolerance. A €50 million annual transport spend company cannot afford the same integration disruption risk as a €500 million operation. But both need frameworks that identify vendors likely to maintain platform stability through ownership changes.

Consider European TMS vendors like Cargoson, Alpega TMS, and established players including Descartes MacroPoint, SAP Transportation Management, and Manhattan Active Transportation Management. Each brings different consolidation risk profiles and technical architectures.

Financial Stability Assessment Beyond Annual Reports

Examine private equity involvement and debt structures, not just revenue growth. Private equity-backed vendors often face pressure to demonstrate exit value within 3-5 years, making them attractive acquisition candidates. Revenue concentration analysis reveals whether vendors depend on a few large customers whose requirements may not align with yours post-acquisition.

The logtech market remains a target for ongoing investment and ownership changes, with this acquisition fitting that pattern of consolidation. Track acquisition target likelihood by monitoring vendor hiring patterns, investment rounds, and market positioning statements. Vendors emphasizing "strategic partnerships" and "platform expansion" often signal preparation for sale.

Integration Architecture Due Diligence

Clean, accurate master data forms the foundation of successful TMS integration. Poor data quality creates errors and inefficiencies that compound during system migrations. Evaluate API maturity through technical documentation review, not just vendor demonstrations.

Legacy TMS platforms struggle with modern integration requirements. Test API response times, data format consistency, and error handling before contract signature. Request specific integration timelines for your ERP system, including testing phases and rollback procedures.

Modern cloud architectures enable faster integrations but require different security and data governance approaches than on-premise installations. Understand how vendor consolidation might affect your integration architecture, especially if acquired platforms operate on different technical foundations.

The European Compliance Advantage: Regulatory Readiness Assessment

European transport regulations create natural barriers to global platform consolidation. The eFTI Regulation applies in full from July 9, 2027, requiring Member State authorities to accept information shared electronically by operators via certified eFTI platforms. This digital transformation could save the EU transport and logistics sector up to €1 billion per year by creating common standards and making systems work together.

Use regulatory compliance as a vendor differentiation criterion. European TMS vendors like Cargoson and Alpega often demonstrate deeper understanding of EU-specific requirements than global platforms adapting American-designed systems for European markets. This regulatory focus provides some protection against acquisition disruption, as compliance capabilities become acquisition criteria rather than post-merger integration challenges.

By July 2027, all Member States will be required to accept electronic transport data via eFTI-certified platforms, marking a significant milestone in EU logistics and supply chain digitalisation. Vendors without clear eFTI roadmaps face competitive disadvantages that make them attractive acquisition targets.

Beyond eFTI: Smart Tachograph and CBAM Integration

Starting August 19, 2025, all heavy-duty vehicles registered in the EU and operating in Member States other than their registration must be fitted with G2V2 smart tachograph devices. Light commercial vehicles above 2.5 tonnes engaged in international road transport require G2V2 tachographs by July 1, 2026.

CBAM (Carbon Border Adjustment Mechanism) definitively applies from 2026 after the transitional phase ends. TMS platforms must integrate carbon reporting capabilities with customs documentation workflows. Vendors demonstrating integrated CBAM compliance show commitment to European market requirements beyond basic transport management.

Contract Protection Strategies for the Consolidation Era

Standard TMS contracts rarely address acquisition scenarios directly. Include specific clauses requiring 12-18 months advance notice of ownership changes, with automatic contract review rights triggered by acquisition announcements. Price protection clauses should lock pricing for 24 months following ownership changes, preventing immediate cost increases during integration periods.

Functionality guarantee clauses protect against feature deprecation common during platform consolidation. Specify that current functionality levels must be maintained for minimum periods, with migration assistance provided if features are discontinued. These protections become more valuable as vendor consolidation accelerates.

Build termination rights triggered by acquisition events, with data portability guarantees and reasonable migration assistance timelines. Enterprise vendors often resist these clauses, but market consolidation risks justify stronger buyer protections.

Migration Assistance and Platform Consolidation Clauses

Require detailed migration assistance specifications, including technical resource commitments, data migration support, and parallel operation periods. Service level agreement maintenance through ownership transitions prevents service degradation during acquisition integration phases.

Define acceptable integration timeline limits. If acquired platforms require 18+ months for full integration, you need temporary dual-platform access or enhanced support during transition periods. Contract language should specify these requirements before they become negotiation issues during actual acquisitions.

Implementation Timeline and Resource Planning

TMS implementation begins before vendor selection through change management preparation. Assess current transportation operations, existing system interfaces, and stakeholder requirements before evaluating vendor capabilities. This preparation identifies integration complexity factors that influence acquisition resistance.

Integrator costs consistently run lower than direct vendor professional services for testing and training phases. Plan for 12-18 month implementation timelines with European TMS solutions like Cargoson typically requiring shorter integration periods than complex enterprise platforms like SAP Transportation Management or Manhattan Active TMS.

Resource planning must account for potential vendor transitions during implementation. Build contingency plans for key integration milestones, including alternative technical resources if primary vendor support becomes unavailable during acquisition periods.

The Five Critical Pre-Implementation Steps

First, assess current transportation operations comprehensively, including carrier relationships, routing complexity, and integration requirements. Second, identify all stakeholders affected by TMS changes, from dispatch teams to finance departments managing freight audits.

Third, define success metrics beyond cost savings, including integration timeline targets and user adoption rates. Fourth, create detailed implementation timelines with vendor-agnostic milestones that remain valid through potential ownership changes.

Fifth, select vendors based on acquisition-resistant criteria rather than feature comparisons alone. Consider platforms like Cargoson alongside larger solutions, evaluating each vendor's consolidation risk profile and European market commitment.

Your 90-Day Action Plan: From Framework to Vendor Decision

Week 1-2: Align stakeholders around acquisition-resistant selection criteria. Review current vendor evaluation processes and identify gaps in consolidation risk assessment. Establish decision-making authority for vendor selection decisions that may need acceleration if acquisition rumors emerge.

Week 3-6: Apply new assessment criteria to shortlisted vendors. Conduct technical architecture reviews, financial stability analysis, and regulatory compliance evaluations. Include European-focused vendors like Cargoson, Alpega, and global platforms with strong European operations including Descartes and SAP.

Week 7-12: Complete deep-dive due diligence on final candidates. Negotiate contract protections for acquisition scenarios, test integration capabilities, and validate regulatory compliance roadmaps. Select vendors demonstrating both technical capabilities and acquisition resistance that protects your implementation investment.

The TMS market will continue consolidating throughout 2026 and beyond. European shippers investing in acquisition-resistant vendor selection frameworks today position themselves to navigate this consolidation successfully, avoiding the integration failures and budget overruns that threaten 66% of technology projects. Your transport management software selection determines whether vendor consolidation becomes a competitive advantage or an expensive operational disruption.