The European Shipper's Capacity Crisis Playbook: How Advanced Freight Visibility Transforms Scarce Transport Resources Into Strategic Advantage in 2025's Tight Market

European manufacturers face an unprecedented transport challenge entering 2025. January 2025 saw a spike in freight offers on the Trans.eu platform, with volume increasing on 14 of 16 key lanes. On some routes, the month-over-month growth exceeded 100%. But carrier activity moved in the opposite direction - dropping both month-over-month and year-over-year. Many carriers are scaling down operations, exiting less profitable routes, or suspending business entirely.

This paradox creates a critical planning challenge. According to IRU's 2024 driver shortage survey, there are 426,000 unfilled truck driver positions across Europe. Even more pressure on logistics teams to secure reliable capacity. The traditional approach of increasing freight rates to secure space no longer guarantees availability.

Advanced freight visibility technology has evolved beyond simple tracking to become a strategic capacity management tool. Shippers expect more than tracking updates. They want proactive communication, automated exception management, and SOP enforcement. For European logistics teams managing €10M+ transport budgets, visibility platforms now offer the operational intelligence needed to navigate capacity constraints while optimizing costs.

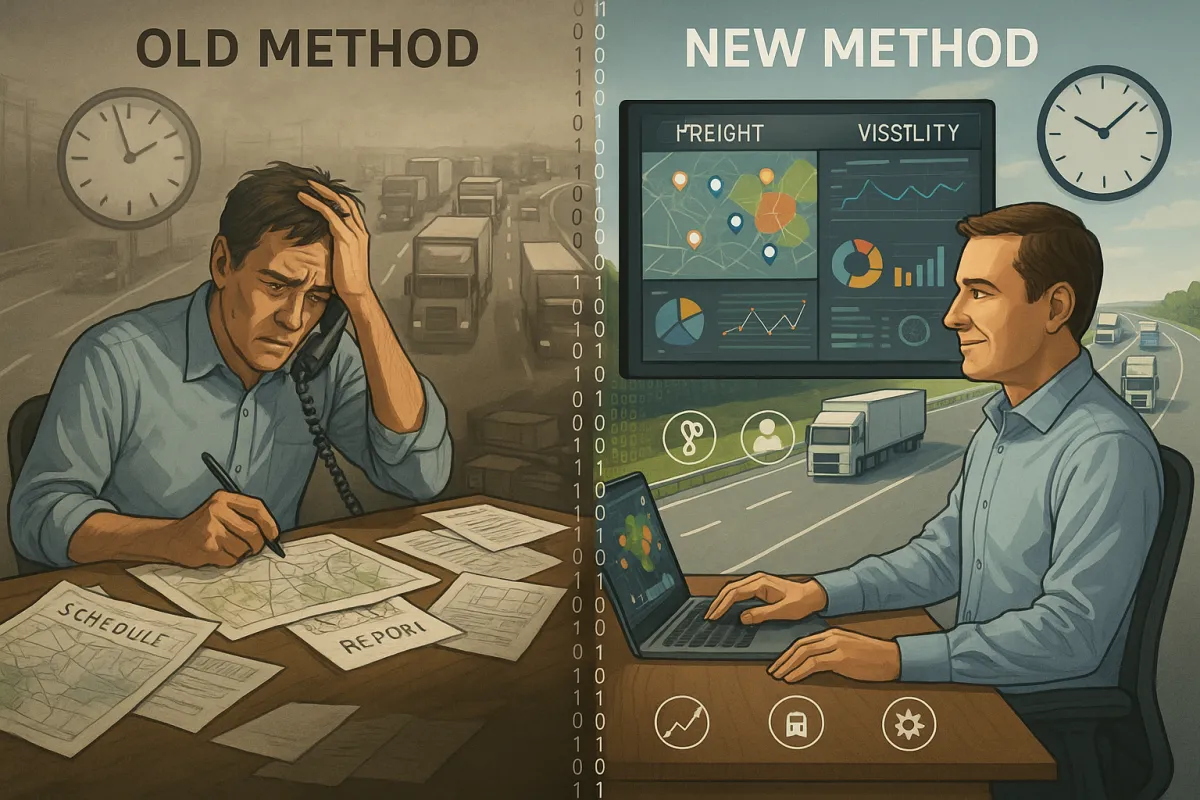

Why Traditional Transport Management Fails in Capacity-Constrained Markets

Most visibility solutions force brokers to juggle multiple tools - one for tracking, another for check calls, and another for document collection. This fragmented approach means brokers still spend too much time managing loads manually. When carrier capacity is scarce, this inefficiency becomes expensive.

The fragmented approach creates three critical problems. First, reactive management dominates. Teams spend hours chasing carriers for updates instead of proactively managing exceptions. Second, capacity decisions lack real-time data. Without live visibility into carrier performance, route efficiency, and delivery windows, procurement teams make suboptimal carrier selections. Third, customer service becomes defensive rather than proactive.

Consider a German manufacturer shipping to Spain. Traditional methods require manual check calls every few hours, document chasing at delivery, and reactive problem-solving when delays occur. Fuel remains the biggest cost driver - averaging €1.57 per liter of diesel in December 2024 (a 4.6% increase from September). Each delay compounds these rising costs while reducing available capacity for future shipments.

Heavy truck registrations fell by over 10% in most EU markets - and by 22.8% in Poland. Instead of modernizing fleets, many carriers are simply keeping older trucks on the road and limiting operations to stay afloat. This capacity reduction makes every available truck more valuable, requiring smarter allocation decisions.

The Advanced Visibility Solution: Beyond Simple Tracking

Freight visibility needs to evolve. Tracking platforms shouldn't just display where a truck is, they should actively manage the shipment. Modern transportation visibility platforms use GPS, RFID and IoT, these platforms enable stakeholders like shippers, carriers, and logistics providers to access real time information regarding the location, status and estimated time of arrival of the goods in transit.

Leading platforms like Shippeo, project44, and FourKites demonstrate this evolution. project44 operates an end-to-end visibility platform that manages more than 1 billion unique shipments annually for over 1,300 brands worldwide, including companies in manufacturing, automotive, retail, life sciences, food & beverage, CPG, and oil, chemical & gas. Similarly, platforms like Cargoson provide European shippers with integrated visibility capabilities that connect directly to TMS systems for comprehensive freight management.

These platforms deliver four key capabilities that matter in tight capacity markets. Proactive exception management identifies delays before they impact delivery windows. reducing check calls, communicating shipper specific requirements to carriers, automating issue resolution, and keeping stakeholders informed without broker intervention. Predictive analytics help anticipate which carriers will accept loads based on historical performance and current market conditions. Real-time geofencing provides automated pickup and delivery confirmations, eliminating manual verification delays.

Predictive Analytics and AI-Powered Decision Making

The capacity crisis demands smarter decision-making tools. This visibility is crucial for managing potential disruptions caused by factors such as traffic, weather conditions or customs delays. By offering features like predictive analytics and instant notifications about delays, RTTVPs enhance decision-making capabilities, improve customer satisfaction through transparency and contribute to overall supply chain efficiency by reducing costs and minimizing delays.

Project44, with a strong shipper focus, offers advanced predictive analytics, helping brokers and shippers anticipate potential delays before they happen. Advanced analytics: Uses AI to predict disruptions and recommend alternative routes. This predictive capability becomes essential when carrier alternatives are limited.

AI-powered platforms analyze historical carrier performance, current market conditions, and real-time traffic data to recommend optimal carrier selections. When your preferred carrier on the Netherlands-Germany route has a 22% delay rate during winter months, the system can automatically suggest alternatives before you tender the load. Cargoson's AI features provide similar predictive capabilities while integrating with existing European TMS deployments.

These systems also enable dynamic rerouting. If your Frankfurt-Milan shipment encounters unexpected delays at the Swiss border, AI algorithms can calculate alternative routes through Austria while automatically communicating changes to all stakeholders. This prevents the domino effect where one delayed shipment impacts subsequent capacity availability.

Strategic Implementation for European Capacity Management

Successful implementation requires a systematic approach to carrier relationship management. Many shippers are already adjusting by securing dedicated carriers, raising freight rates to ensure reliable service, or investing in driver-friendly facilities. Visibility platforms support this strategy by providing the data needed to identify and reward high-performing carriers.

Start with core carrier program consolidation. Rather than spreading volumes across dozens of carriers, concentrate shipments with fewer, more reliable partners. Use visibility data to track carrier performance metrics: on-time pickup rates, delivery reliability, communication responsiveness, and fuel efficiency. The data reveals which carriers deserve dedicated capacity agreements and premium rates.

Consider a European automotive parts supplier with routes from Munich to Barcelona. Historical data shows Carrier A delivers 94% on-time with average fuel efficiency 8% above industry standards, while Carrier B manages only 78% on-time despite 5% lower rates. In a capacity-constrained market, the premium for Carrier A becomes a wise investment that reduces expediting costs and customer penalties.

TMS integration becomes critical for scaling these insights. Platforms like Transporeon, MercuryGate, and nShift handle large-scale European operations, while Cargoson provides similar integration capabilities with European ERP systems. The goal is embedding visibility data directly into procurement decisions.

Proactive Capacity Securing Strategies

Traditional transport procurement assumes capacity availability. The 2025 market requires procurement teams to secure capacity first, then optimize routes and timing. Many B2B shippers are adopting index-linked fuel surcharges and dynamic pricing mechanisms in their contracts to accommodate volatility. Some are diversifying carrier bases and securing dedicated capacity to avoid spot-market price swings.

Implement automated alerts for capacity threats. When your regular Milan-Paris carrier shows increasing delays or missed pickups, the system should trigger alternative carrier sourcing before current contracts expire. Geofencing technology provides early warning when carriers deviate from planned routes, indicating potential capacity issues.

Dynamic pricing integration helps balance cost and reliability. Instead of fixed-rate contracts that carriers abandon when market rates rise, use index-linked pricing that adjusts with market conditions. cost pressures - such as fuel and wages - are helping to keep rates high. The rise in export volumes from Germany and Italy is likely to continue, especially towards France, Switzerland, and Spain. Visibility platforms provide the real-time market data needed for these dynamic adjustments.

Build diversified carrier networks across different business models. Combine dedicated fleets for predictable volumes, preferred carriers for regular routes, and spot market access for overflow. Visibility platforms help optimize this mix by tracking performance across all carrier types and automatically allocating loads to the most appropriate option.

ROI Measurement and Business Case Development

Quantifying visibility platform ROI requires measuring both cost savings and capacity security benefits. Direct cost reductions include reduced dwell time, fewer expedited shipments, and decreased administrative overhead. enhance decision-making capabilities, improve customer satisfaction through transparency and contribute to overall supply chain efficiency by reducing costs and minimizing delays.

Calculate the administrative savings first. If your logistics team currently makes 50 check calls daily at 15 minutes each, automated tracking saves 12.5 hours daily. At €45 per hour fully loaded cost, that's €563 daily or €145,380 annually for a mid-sized operation. Add document collection automation and exception management, and administrative savings often exceed platform costs within six months.

Capacity security provides larger but harder-to-measure benefits. When preferred carriers consistently perform well, they're more likely to accept future loads even in tight markets. A 5% improvement in carrier retention can reduce spot market dependency by 15-20%, protecting against rate spikes that averaged 9-14% on major European routes during capacity crunches.

Customer satisfaction improvements compound over time. Proactive communication about delays reduces customer complaints and strengthens relationships. One German chemical company reduced customer penalty payments by 73% after implementing comprehensive visibility, protecting €2.1M in annual revenue that previously went to expediting and penalty costs.

Transportation spending optimization emerges from better carrier selection and route planning. The volumes are expected to grow at a 2% CAGR from 2024 to 2029. Visibility platforms help capture this growth efficiently by ensuring capacity availability without premium pricing.

Future-Proofing Your Transport Strategy for 2025 and Beyond

The outlook for 2025 is cautiously optimistic. Those who can blend real-time market insights with operational flexibility will gain a true competitive edge in 2025. The European freight landscape will remain challenging, but digital transformation creates competitive advantages for prepared shippers.

AI adoption accelerates across European road freight. AI adoption is increasing, as evidenced by 16 case studies of active applications included in the report. Early adopters gain significant advantages in carrier negotiation, route optimization, and capacity planning. Platforms like FreightPOP, Shipwell, and 3Gtms provide various approaches, while Cargoson focuses on European market requirements and ERP integration.

ERP integration becomes increasingly sophisticated. Rather than standalone visibility tools, expect deeper connections between transport management and core business systems. This integration enables automatic purchase order tracking, inventory optimization based on transit times, and financial planning that accounts for transport variability.

Sustainability requirements add another layer of complexity. Shippeo also supports sustainability initiatives by providing insights into carbon emissions associated with transportation activities, allowing organizations to track their environmental impact. Visibility platforms help optimize routes for carbon efficiency while maintaining delivery reliability.

Prepare for continued capacity constraints through 2025. Driver shortages, already a critical issue, are predicted to worsen dramatically, with unfilled positions potentially exceeding 60% by 2026. The shippers who invest in advanced visibility technology now will have competitive advantages when capacity becomes even scarcer.

Start with pilot programs on critical routes. Implement comprehensive tracking on your highest-volume or most critical lanes first. Measure results rigorously, then expand to cover your full network. The European transport market rewards companies that move quickly on digital transformation while punishing those that delay adaptation.

The capacity crisis of 2025 creates both challenges and opportunities. Advanced freight visibility technology transforms scarce transport resources into competitive advantages, but only for shippers who implement these tools strategically and comprehensively. Your capacity security and cost optimization depend on making this transition successfully.