The European Shipper's Guide to Advanced Load Consolidation: How Smart TMS Strategies Can Cut LTL Costs by 25% While Adapting to 2025's Flexible Supply Chain Demands

LTL shipping is experiencing unprecedented growth across Europe, with international LTL shipping dominating the market with over 67% share in 2024 and LTL consignments advancing at a 3.49% CAGR between 2025 and 2030. This shift represents a fundamental change in how European manufacturers and retailers structure their supply chains. LTL consignments flourish on e-commerce parcel densities that justify daily cross-dock departures from hub-and-spoke terminals across Germany, Benelux, and Poland.

The numbers tell the story: Germany market with a 52% share, generating USD 4.01 billion in revenue in 2024, while the underlying market drivers continue strengthening. Your warehousing strategy matters less when you can consolidate shipments efficiently through advanced TMS capabilities - and that's where most European shippers fall short.

Heavy LTL volume holds the highest market share in the less-than-truckload market due to its ability to transport larger, consolidated freight shipments while avoiding Full Truckload costs, typically including shipments weighing between 7,000 to 20,000 pounds. But here's the challenge: Europe freight brokerage services market size for LTL consolidation will expand as brokers deploy algorithmic load building that boosts trailer utilization - yet most in-house operations still rely on geographic grouping and basic weight calculations.

The €2.3 Million Hidden Cost of Poor Consolidation Decisions

A mid-sized German automotive parts supplier recently discovered they were spending €800,000 annually on suboptimal LTL consolidation. Their approach seemed logical: group shipments by postal codes, combine anything heading to similar regions, and prioritize full trailer utilization. The reality proved more complex.

The cost breakdown revealed the consolidation paradox in action. By combining a time-sensitive automotive component shipment (requiring next-day delivery) with standard industrial supplies (5-day delivery window), they created a service level mismatch that forced premium pricing across both shipments. The automotive parts alone should have cost €180 per shipment; the consolidation approach pushed the blended rate to €340 per shipment.

Geographic consolidation without temporal optimization particularly hurts cross-border movements. Brexit-related customs checks add cost to UK-EU lanes, yet dedicated consolidation hubs in Kent and Calais are shortening clearance windows to preserve service reliability. Companies consolidating shipments across different customs regimes often discover their "efficient" loads create documentation bottlenecks that eliminate any transportation savings.

Currency fluctuations add another layer of complexity. When consolidating shipments from multiple European origins, currency timing can impact the economics significantly. A Netherlands-based wholesaler found their Poland-to-Germany consolidation strategy worked perfectly until EUR-PLN volatility made their pre-negotiated rates unprofitable within days.

Why Traditional Geographic Grouping Fails European Operations

The driver shortage compounds consolidation challenges. According to IRU's 2024 driver shortage survey, there are 426,000 unfilled truck driver positions across Europe, and without decisive intervention, that number could balloon to 745,000 by 2028. This scarcity means carriers increasingly favor loads that optimize driver utilization rather than simple geographic efficiency.

Smart consolidation considers delivery time windows, not just destinations. A shipment to Munich requiring Tuesday morning delivery cannot efficiently consolidate with Friday-flexible cargo, regardless of geographic proximity. The temporal mismatch forces sub-optimal routing or service failures.

Multi-modal considerations further complicate traditional approaches. LTL is growing at CAGR of 3.66% between 2025-2030 as parcel fragmentation climbs. Retailers break bulk at fulfillment centres, producing pallets that flow into hub-and-spoke networks. Your consolidation strategy must account for intermodal transfer points, not just final destinations.

Advanced TMS Consolidation: Beyond Basic Geographic Grouping

Modern transport load consolidation requires algorithmic approaches that consider multiple variables simultaneously. The subcomponents of TMS core capabilities make up a comprehensive solution across transportation planning including load consolidation, mode and carrier selection, and route optimization. But implementation varies dramatically between platforms.

Dynamic consolidation algorithms evaluate shipments in real-time rather than batch processing. When a new shipment enters your system, advanced TMS software like Cargoson instantly assesses consolidation opportunities across existing loads, considering weight, volume, delivery windows, special handling requirements, and carrier constraints. This real-time approach can identify savings missed by weekly or monthly consolidation planning cycles.

Time-window optimization balances customer service with efficiency. The algorithm considers not just delivery deadlines but pickup flexibility, customer preferences, and carrier capacity constraints. A Munich-bound shipment with a Thursday deadline might consolidate better with Wednesday Hamburg cargo if the route optimization creates sufficient time buffers.

MercuryGate key features include multi-modal transportation planning and load optimization and consolidation, while solutions like Descartes and Transporeon offer varying approaches to the consolidation challenge. The key differentiator lies in how these platforms handle European-specific requirements: cross-border documentation, VAT calculations, and CMR compliance integration.

Cross-Modal Consolidation: The European Advantage

European infrastructure enables sophisticated intermodal consolidation strategies unavailable elsewhere. A Dutch wholesaler reduced transport costs by 22% through multi-modal consolidation that combined road collections, rail trunk haul, and final-mile delivery. Their TMS identified opportunities to consolidate LTL shipments onto rail corridors between major hubs, then de-consolidate for local delivery.

The Netherlands leverages Rotterdam's port connectivity to stage trans-shipment cargo into Germany and Scandinavia, illustrating how gateway infrastructure multiplies cross-border runs. This infrastructure advantage requires TMS platforms that understand intermodal transfer points and can optimize consolidation across transport modes.

Rail integration particularly benefits heavy LTL consolidation. Heavy LTL volume segment dominates the market with 77% of revenue share and is expected to grow at a CAGR of over 6.3% from 2025 to 2034. Combining multiple heavy LTL shipments for rail trunk haul between major European cities often delivers 15-25% cost savings compared to direct road transport.

Implementation Roadmap: 90 Days to Advanced Consolidation

Successful TMS consolidation implementation follows a structured approach. Start with data analysis and baseline establishment during weeks 1-4. Document current consolidation practices, measure load factors by lane, and identify your biggest cost optimization opportunities. Calculate current cost per shipment across major routes and establish KPI baselines.

Phase 2 (weeks 5-8) focuses on TMS configuration and testing. Modern platforms like Cargoson, MercuryGate, or Descartes require careful setup of consolidation rules. Configure weight and volume constraints, define service level requirements, and establish carrier-specific parameters. Test consolidation algorithms against historical data to validate savings projections.

Cloud solutions typically achieve these savings within 3-6 months, while on-premise implementations often require 12-18 months to show meaningful returns. This timeline difference significantly impacts ROI calculations and cash flow planning.

Full deployment and optimization (weeks 9-12) includes user training, process refinement, and performance monitoring. Track load factor improvement, cost per shipment reduction, and customer satisfaction metrics. Less-than-truckload is expanding at an 8.9% CAGR as e-commerce drives demand for smaller consolidated shipments, making accurate performance measurement crucial for optimization.

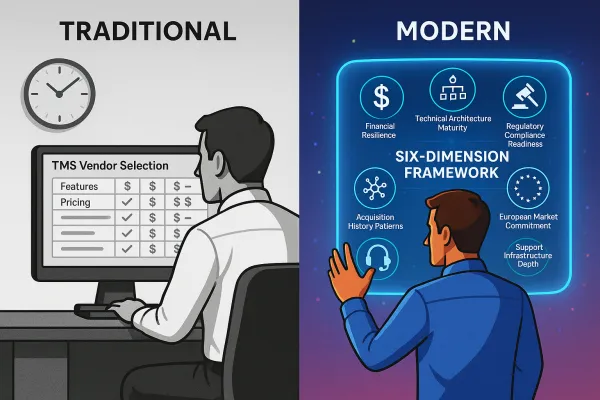

Selecting Your TMS for Advanced Consolidation

Feature requirements vary significantly between platforms. Essential capabilities include dynamic load matching, multi-constraint optimization (weight, volume, delivery windows), carrier-specific rule sets, and real-time rate comparison. European operations require additional features: cross-border documentation automation, VAT handling, and CMR integration.

ERP integration capabilities determine implementation success. Whether you run SAP, Oracle, or other enterprise systems, ensure your TMS provider offers proven integration paths. Alpega is connected to 80,000+ transport professionals across Europe. In 2025, they launched Alpega MultiParcel which also connects to over 1,000 parcel carriers. But carrier connections matter less than consolidation algorithm sophistication.

Vendor comparison reveals different specializations. Enterprise solutions like Blue Yonder and Manhattan Active offer sophisticated forecasting and planning capabilities but require significant implementation resources. Mid-market solutions like Cargoson focus on faster deployment with built-in European compliance features. Established players like Transporeon and nShift provide extensive carrier networks but varying consolidation optimization capabilities.

Measuring Success: The 25% Cost Reduction Reality

ROI calculation methodology determines project success measurement. Direct savings include freight cost reduction through improved load factors, reduced accessorial charges through better planning, and labor savings from automation. Indirect benefits include improved customer service through better delivery reliability and enhanced sustainability metrics.

A European electronics manufacturer achieved 23% LTL cost reduction within six months of TMS deployment. Their baseline showed 68% average load utilization across major lanes. Advanced consolidation algorithms improved this to 87% while maintaining service levels. The 19-percentage-point improvement in load factor translated directly to cost reduction.

Before/after scenarios demonstrate typical results. A pharmaceutical distributor reduced average shipment costs from €420 to €315 per LTL load through better consolidation. Their improvement came primarily from temporal optimization - consolidating time-compatible shipments instead of purely geographic grouping. This approach reduced premium pricing while maintaining delivery performance.

A well-optimized TMS typically generates 15 to 25% kilometer savings, with an average cost of €0.45 per kilometer for a utility vehicle, meaning each kilometer saved represents a direct measurable gain. But savings vary dramatically based on implementation quality and initial optimization levels.

Future-Proofing Your Consolidation Strategy

AI and machine learning trends reshape consolidation optimization. Rose Rocket unveiled TMS.ai at the Manifest 2025 conference, marking a significant evolution in transportation management systems, placing artificial intelligence at the core of the business's system-of-record. These advances enable predictive consolidation that anticipates demand patterns and pre-positions inventory accordingly.

Sustainability requirements increasingly influence consolidation decisions. The best TMS software pre-calculates CO2 emissions for each shipment before placing an order and takes account carrier fleet & service speciality. European CSRD requirements mandate detailed carbon reporting, making emissions optimization a consolidation criterion alongside cost and service.

Autonomous vehicle integration will revolutionize consolidation economics. When driver costs disappear, optimal load building shifts toward maximizing vehicle utilization rather than minimizing labor costs. TMS platforms preparing for this transition focus on volume optimization algorithms rather than traditional cost-per-kilometer calculations.

Blockchain technology enables multi-party consolidation arrangements with competitors. Shared consolidation across multiple shippers requires trust and transparency mechanisms that blockchain can provide. Early pilots in the Netherlands demonstrate 30-40% additional savings through industry consolidation versus individual company optimization.

The European transport management systems market reflects these innovation trends. The Europe transportation management systems market size was valued at USD 2.70 billion in 2022 and is expected to expand at a CAGR of 12.1% from 2023 to 2030, driven by e-commerce rise and significant ROI provided by transportation management systems. Companies investing in advanced consolidation capabilities today position themselves advantageously for this growth.