The European Shipper's Guide to Carrier Performance Management: Building Resilient Transport Networks in 2025's Capacity-Constrained Market

The transport capacity challenge choking European businesses has reached a critical inflection point. According to IRU's 2024 driver shortage survey, there are 426,000 unfilled truck driver positions across Europe, while heavy goods vehicle registrations fell by 16% between Q1 2024 and Q1 2025. This isn't just a temporary shortage – without decisive intervention, that number could balloon to 745,000 by 2028 due to retiring drivers.

For European shippers managing their own transport operations, these numbers translate into a hard reality: building carrier performance management systems isn't just about optimizing costs anymore – Europe's strong focus on sustainability, cross-border trade, and regulatory compliance is driving demand for transportation optimization tools due to increasing environmental concerns and the EU's emphasis on reducing carbon emissions in logistics.

The New Reality: Europe's Transport Capacity Crisis in 2025

The structural problems run deeper than temporary market fluctuations. The average European truck driver is 47 years old, and 30% are over 55 — a retirement cliff is looming. At the same time, only 5% of drivers are under 25, and a mere 4% are women.

More than half of European trucking companies report they cannot expand due to driver shortages; 48% are experiencing lower productivity, and 39% are seeing revenue decline. And while economic slowdowns have temporarily masked the problem, the IRU warns that when demand returns, the labor bottleneck will snap back — harder.

The capacity constraints are already visible in market data. New capacity entering the market has been constrained. Heavy goods vehicle registrations fell by 16% between Q1 2024 and Q1 2025, and by 7% q-o-q. For European manufacturers and retailers managing their own fleets or working with multiple carriers, this creates a perfect storm where traditional procurement strategies lose effectiveness.

Why Traditional Carrier Management Strategies Are Failing

Most European shippers built their carrier strategies around abundance. Rate negotiations focused on driving prices down, performance management relied on switching between multiple options, and capacity planning assumed reliable supply. That world is ending.

Businesses will increasingly blend contracts for baseline capacity, using spot rates for flexibility. As a result, the uncertainty could dampen the impact of rising demand on the contract market and amplify pressure on the spot market. The old playbook of pitting carriers against each other for the lowest rate is becoming counterproductive when those carriers are already operating at capacity limits.

European shippers are discovering that carriers with strong financial positions and modern fleets now hold more negotiating power. Countries like Estonia and Poland are already seeing the impact, with local operators forced to decline shipments or raise prices due to staffing shortages. This shift requires rethinking not just procurement tactics, but the entire approach to carrier relationships.

The challenge becomes more complex when you factor in regulatory changes. The Smart Tachograph version 2 will be mandatory for newly registered vehicles as of 21 August 2023 and for all vehicles involved in international transport as of 18 August 2025. Carriers facing upgrade costs of €1,700-€2,200 per vehicle while dealing with driver shortages may exit less profitable routes entirely.

The Strategic Framework for Carrier Performance Management

Building resilient carrier networks starts with recognizing that transportation capacity management is not just a procurement function – The global transportation management system market size was estimated at USD 15.88 billion in 2024 and is estimated to reach USD 41.57 billion by 2030, growing at a CAGR of 17.5% from 2025 to 2030. The factors driving the global transportation management system (TMS) industry include the growth of retail and e-commerce industries, consistent advancement in technology leading to the introduction of innovative solutions in the market.

Your KPI framework needs to shift from purely cost-focused metrics to balanced scorecards that measure relationship health alongside performance. Track carrier financial stability through publicly available data, monitor their investment in driver retention programs, and measure their compliance readiness for new regulations like the smart tachograph requirements.

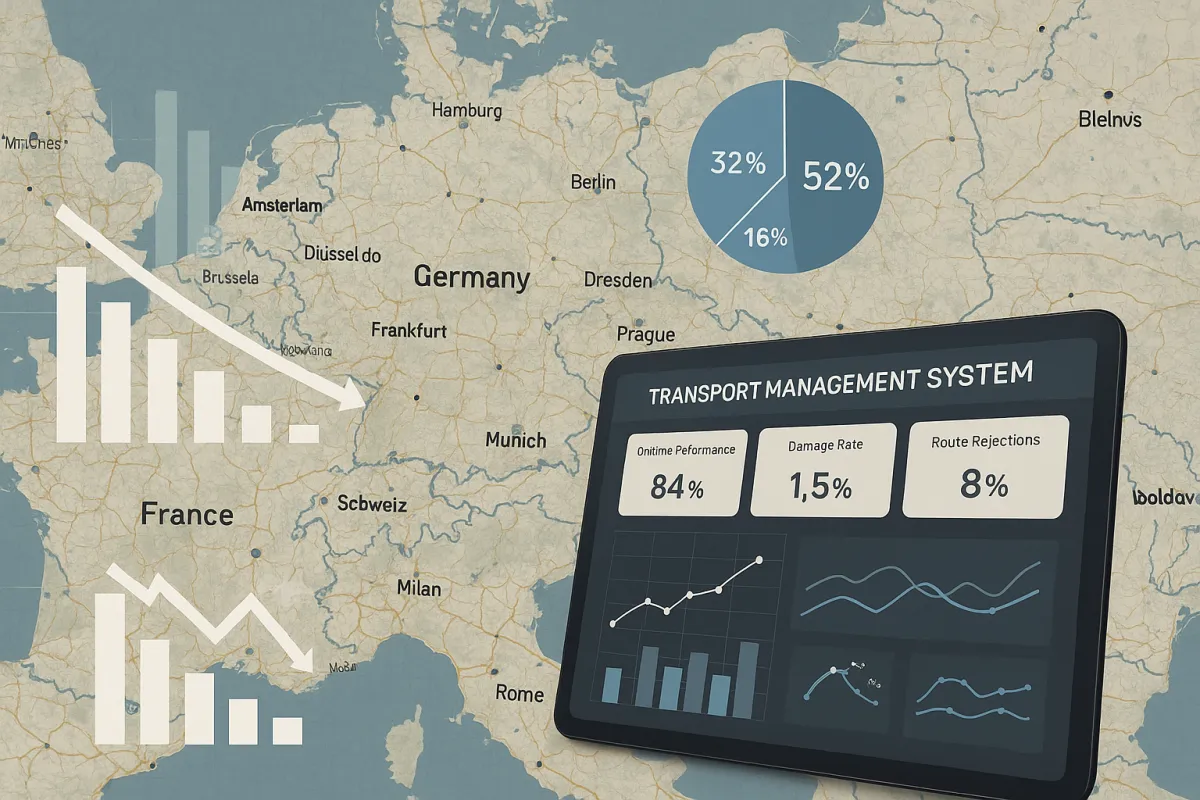

Modern TMS platforms like Cargoson, alongside established solutions from MercuryGate, Descartes, and Manhattan Active, now offer performance analytics that can automatically flag carriers showing signs of stress. Look for declining on-time performance, increasing damage rates, or patterns of route rejections – these often signal operational problems before they affect your shipments.

Create performance tiers that reward your most reliable carriers with preferred status, better payment terms, and collaborative forecasting access. This isn't about playing favorites; it's about recognizing that carrier capacity is becoming a scarce resource that requires strategic management.

Implementing Capacity Forecasting and Demand Planning

Accurate forecasting can significantly improve cost management and service reliability. The days of reactive transportation planning are ending – European shippers need to think like capacity brokers, anticipating demand and securing resources in advance.

Start by analyzing your transport patterns at a granular level. Which lanes show seasonal variations? Where do you compete with other shippers for the same carrier capacity? Which routes have become problematic due to driver preferences or regulatory complexity? Understanding these patterns allows you to approach capacity planning strategically rather than tactically.

Oracle TM, SAP TM, and Cargoson offer advanced planning capabilities that can model different scenarios and help you identify potential capacity gaps months in advance. The key is building forecast models that consider both your demand patterns and the carriers' operational constraints.

Consider implementing rolling 12-month capacity commitments with your core carriers. This provides them with demand visibility that helps their own planning while giving you priority access during tight markets. The approach requires more sophisticated forecasting but pays dividends in service reliability.

Technology Solutions: TMS Features That Matter Most

The European TMS market reflects regional priorities around compliance and sustainability. The value of the European TMS market reached around € 1.2 billion in 2023. Growing at a compound annual growth rate (CAGR) of 12.1 percent, the market value of transport management systems in Europe is forecasted to reach € 2.1 billion in 2028.

Real-time visibility becomes crucial when capacity is constrained. TMS platforms that automate routine tasks such as load tendering, invoicing, and payment processing reduce manual errors and accelerate the shipping process – but they also free up your team to focus on relationship management and exception handling.

Transporeon, nShift, and Cargoson have built specific functionality for European requirements like cross-border documentation, VAT handling, and CMR compliance. Look for systems that can automatically generate the paperwork for smart tachograph compliance and track carrier certifications.

The most valuable TMS features in today's market aren't necessarily the flashiest AI-powered optimization engines. They're the boring but reliable integrations that connect to your carriers' systems, provide automated alerts when shipments go off-track, and maintain detailed performance histories that inform your carrier selection decisions.

Building Collaborative Partnerships in Uncertain Times

The ongoing pressure on transport capacities and costs is causing more companies to consider working together more closely. Since January 2024, the EU's Emissions Trading System (EU ETS) has been extended to cover CO2 emissions from all large ships (of 5 000 gross tonnage and above) entering EU ports, regardless of the flag they fly. These regulatory costs are pushing shippers and carriers toward more strategic partnerships.

Successful partnerships require transparency on both sides. Share your volume forecasts, seasonal patterns, and growth plans with key carriers. In exchange, expect visibility into their capacity planning, driver recruitment efforts, and equipment investments. This level of collaboration requires trust, but it's becoming necessary for securing reliable capacity.

E2open/BluJay, Alpega, and Cargoson offer collaborative planning tools that allow you to share forecast data with carriers while maintaining competitive confidentiality. These platforms can automatically generate RFQ packages that include your volume commitments, helping carriers provide more accurate pricing.

Consider joint initiatives with your carriers around driver recruitment or retention. Some European shippers are co-funding training programs or contributing to driver facilities improvements at their key partners. These investments strengthen the relationship while addressing the root cause of capacity constraints.

Regulatory Compliance and Future-Proofing Your Network

By 21 August 2025, this requirement will also apply to vehicles with a smart tacho 1. As of August 2025, all trucks and buses will be required to have a Smart Tacho 2 installed. This applies to both new and older vehicles. The implementation deadlines are creating additional pressure on an already strained carrier market.

Carriers who haven't planned for smart tachograph upgrades may face service disruptions or exit international routes entirely. Your carrier due diligence process needs to include questions about tachograph compliance timelines, upgrade budgets, and contingency plans for potential enforcement actions.

The emissions trading system adds another layer of complexity. To ensure a smooth transition, shipping companies only have to surrender allowances for a portion of their emissions during an initial phase-in period: 2025: for 40% of their emissions reported in 2024; 2026: for 70% of their emissions reported in 2025; 2027 onwards: for 100% of their reported emissions. Road transport isn't directly affected, but intermodal shippers need to factor these costs into their mode selection decisions.

3Gtms/Pacejet, Shiptify, and Cargoson help with regulatory compliance by automating documentation, tracking certification requirements, and maintaining audit trails. The key is choosing systems that can adapt to evolving requirements without major configuration changes.

Building resilience in 2025's transport market requires shifting from transactional relationships to strategic partnerships. The combination of capacity constraints, regulatory pressure, and technological change is forcing a fundamental rethink of how European shippers manage their transport networks. Those who adapt their carrier performance management strategies to this new reality will secure the reliable capacity they need to serve their customers. Those who don't may find themselves scrambling for transport options at premium prices – if they can find them at all.