The European Shipper's Guide to Freight Procurement When Spot and Contract Rates Converge: Strategic Portfolio Management for 2025's Unprecedented Market Balance

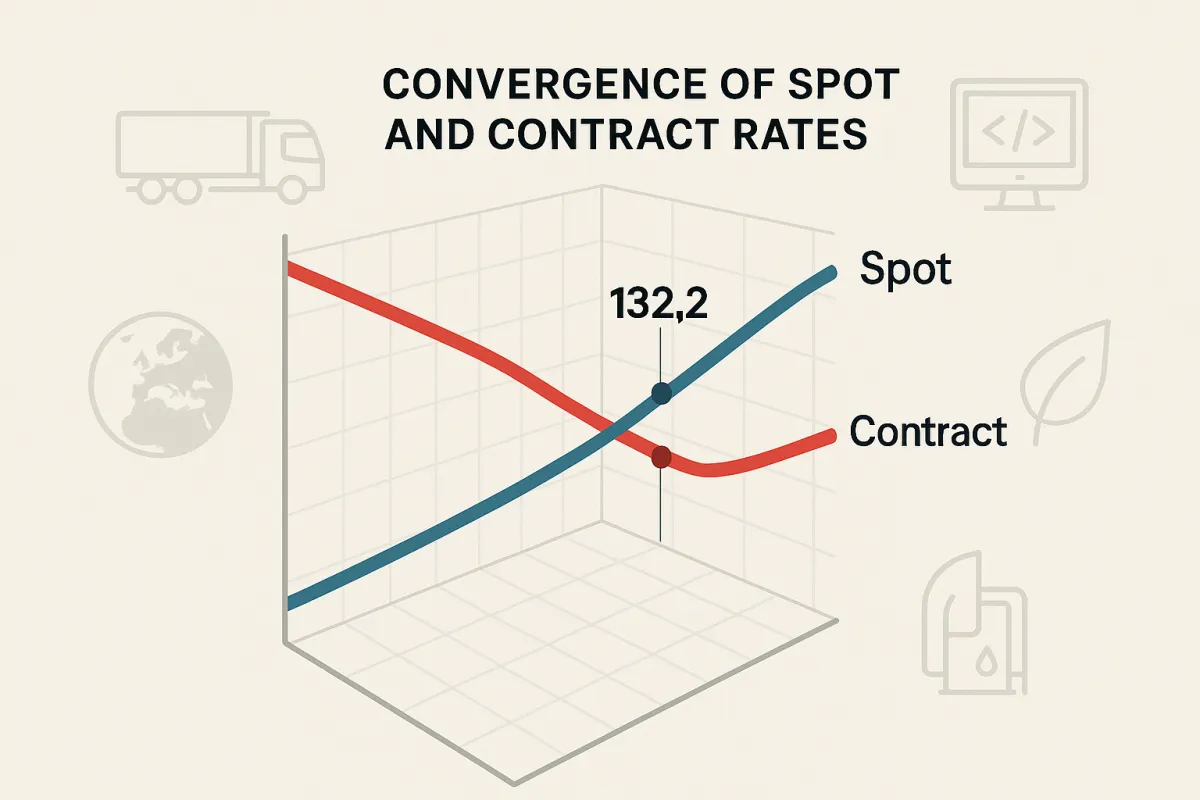

Something unprecedented just happened in European freight markets. The Upply x Ti x IRU study on European road freight rates in Q2 2025 shows that the contract and spot rate indexes have converged at 132.2. For procurement professionals who've built their strategies around exploiting the usual 10-15% spread between contract and spot rates, this convergence changes everything.

This isn't just another quarterly fluctuation. Spot rates are now at their lowest level since Q4 2023, while contract rates have remained relatively stable. The result? Your traditional freight procurement playbook needs a complete rewrite.

Why This Convergence is Different from Previous Market Cycles

Thomas Larrieu, Chief Executive Officer at Upply, comments: "The convergence of spot and contract rates reflects a fragile balance in the European road freight market". This fragility stems from a fundamental split in the market that hadn't existed in previous cycles.

Given the weakness of demand, carriers are finding it difficult to pass on the full increase in their operating costs. Here's what makes this different: we're seeing carriers struggling with cost pressures while demand remains tepid. The benchmark spot rate index declined by 2.2 points quarter-on-quarter, while the contract rate index inched up by 1.2 points over the same period.

The market fundamentals show a clear picture. Q2 2025 diesel prices were down by 6.4% vs Q1 2025, though prices have risen in recent weeks following the Israel-Iran war. Unlike previous market cycles where rate convergence occurred during peak demand periods, this convergence is happening during a period of moderate demand recovery.

Trades by road between major economies (Germany, France, Poland, Italy and Spain) are showing a rebound from December 2024 low point up to April 2025, but the recovery isn't translating into the typical rate spreads procurement teams have relied on for optimization.

The Strategic Implications: Rethinking Your Contract-Spot Portfolio Mix

Traditional procurement models typically allocate 70-80% of volume to contracts with 20-30% on spot rates to capture market opportunities. Rate convergence destroys this model's effectiveness. When there's no meaningful price differential, your allocation strategy becomes purely about capacity security and operational convenience.

Ti Head of Commercial Development Michael Clover said, "However, with spot rate growth drifting down, there may be opportunities to secure cheaper rates outside of contracts through the second half of the year". This insight points to a critical strategic shift: instead of fixed allocation percentages, procurement teams need dynamic balancing capabilities.

The implications extend beyond simple rate arbitrage. Despite early signs of recovery, demand remains moderate, and pressure on the spot market is therefore low. This creates an environment where spot capacity is more readily available than in typical market cycles, fundamentally altering the traditional capacity-security argument for contracts.

Modern transport management platforms are adapting to this reality. Solutions like Cargoson, along with established players like Alpega and E2open/BluJay, now offer dynamic portfolio management tools that automatically adjust contract-spot allocations based on real-time rate convergence patterns. These platforms monitor rate spreads across individual lanes and suggest tactical shifts when convergence occurs.

The End of Traditional Fixed Allocation Models

Fixed percentage allocations made sense when rate spreads were predictable and substantial. A European automotive manufacturer I worked with historically maintained 75% contract coverage specifically to exploit the 12-18% spot premiums during peak seasons. With convergence, they're piloting a dynamic model where allocation percentages shift monthly based on rate spread thresholds.

The shift requires both technology and process changes. Your procurement team needs real-time visibility into rate spreads across all major European corridors, not just quarterly reviews. This means investing in platforms that provide lane-specific rate tracking and automated alert systems when convergence patterns emerge.

Tactical Procurement Strategies for Rate Convergence Periods

When price differentials disappear, procurement strategy shifts from rate arbitrage to operational optimization. The focus moves to carrier performance, capacity reliability, and contractual flexibility rather than pure cost minimization.

During convergence periods, contract negotiations should prioritize flexibility clauses over rate locks. Include provisions for quarterly rate reviews tied to benchmark indexes, and negotiate volume flexibility that allows you to shift allocations without penalties. There may be opportunities to secure cheaper rates outside of contracts through the second half of the year, but only if your contracts allow for volume adjustments.

Technology platforms become even more important during convergence. Traditional TMS solutions like SAP TM and Oracle TM weren't designed for rapid tactical shifts between contract and spot procurement. More agile platforms like Transporeon, Descartes MacroPoint, and Cargoson offer automated switching mechanisms that can redirect volumes to spot markets when rate differentials favor this approach.

The tactical approach also requires carrier relationship management that goes beyond transactional rate negotiations. When rates converge, service quality and capacity reliability become the primary differentiators. Your procurement strategy needs to account for carrier performance metrics that matter during tight capacity periods, not just rate competitiveness.

The Lane-by-Lane Analysis Approach

Rate convergence doesn't occur uniformly across all European corridors. Trades by road between major economies (Germany, France, Poland, Italy and Spain) are showing a rebound from December 2024 low point up to April 2025, but the recovery patterns vary significantly by lane.

Major corridors like Germany-Netherlands and France-Spain might maintain traditional rate spreads while secondary routes experience full convergence. Your procurement strategy needs lane-specific tactics rather than portfolio-wide approaches. This requires detailed analysis of your top 20-30 corridors and individual allocation strategies for each.

Successful lane-by-lane management requires technology that can handle the complexity. Platforms need to track not just current rates but also historical spread patterns and volatility metrics for each corridor. This data enables predictive modeling that identifies which lanes are likely to experience convergence and which maintain traditional spread dynamics.

Building Agile Procurement Processes for Market Volatility

Rate convergence periods highlight the limitations of annual contract cycles and quarterly strategy reviews. The outlook for rates across Europe is for a modest upward pressure, as demand improves and operating costs remain relatively stable, but market conditions can shift within weeks rather than quarters.

Agile procurement requires monthly strategy reviews with the ability to make tactical adjustments between formal tender cycles. This means structuring contracts with volume flexibility and maintaining pre-negotiated spot rate agreements with multiple carriers. The goal is operational agility without sacrificing cost control.

The process redesign extends to carrier management. Instead of annual relationship reviews, implement monthly performance assessments that track capacity availability, on-time delivery, and rate competitiveness. This data feeds into allocation decisions that can shift volumes between carriers based on current market conditions rather than historical relationships.

Technology integration becomes the enabler of agile processes. Modern platforms like nShift, Manhattan Active, and Cargoson offer automated performance monitoring and allocation optimization tools. These platforms can trigger reallocation decisions based on predefined criteria, reducing the manual workload of constant market monitoring.

Technology Integration for Dynamic Procurement

Real-time rate monitoring is the foundation of dynamic procurement strategies. Your technology stack needs to provide lane-specific rate tracking, automated convergence alerts, and allocation optimization recommendations. This goes beyond traditional TMS functionality to include market intelligence and predictive analytics.

The integration challenge involves connecting market data feeds with internal procurement workflows. A 2024 McKinsey report found that AI-driven procurement platforms reduce costs by up to 15% while improving supplier transparency and contract efficiency. These platforms analyze not just current rates but also market trend patterns that predict convergence periods.

Automated switching mechanisms represent the next evolution in procurement technology. When rate spreads fall below predetermined thresholds, the system automatically shifts volume allocations and triggers spot market RFQs. This automation enables tactical responses to market changes within days rather than weeks.

Preparing for the Next Divergence: Market Signals to Watch

The outlook for rates across Europe is modest upward pressure, driven by seasonal restocking ahead of the holiday period and gradual recovery in manufacturing activity. The key indicators suggest convergence is a temporary phenomenon, but timing the return to divergence requires careful market monitoring.

The Eurozone manufacturing Purchasing Managers' Index (PMI) reached 50.7 in August, the first reading above the growth threshold since mid-2022, although it fell back to 49.8 in September. This manufacturing recovery creates the demand foundation for rate divergence, but the timeline remains uncertain.

Forward-looking procurement strategies need to position for both scenarios: continued convergence through 2025 and potential divergence in 2026. This requires maintaining operational flexibility while preparing for traditional rate spread opportunities. Your technology platform should monitor leading indicators like manufacturing PMI, retail trade volumes, and capacity utilization rates.

There are 426,000 unfilled truck driver positions across Europe, according to IRU's 2024 survey. This structural capacity constraint means that when demand does recover, rate divergence could occur rapidly and substantially. Your procurement strategy needs to account for this potential whipsaw effect.

Q4 2025 and 2026 Procurement Planning

No further adjustments are expected in Q4 2025, though major changes are anticipated for 2026. This timeline suggests current convergence conditions may persist through the remainder of 2025, requiring procurement strategies that optimize for this extended period rather than treating convergence as a short-term anomaly.

Planning for 2026 requires scenario modeling that accounts for potential rate divergence patterns. The convergence of spot and contract rates points to a gradual rebalancing of the European road freight market after several quarters of adjustment. While this trend reflects improving stability, notable disparities remain across countries and lanes.

The preparation strategy involves building procurement flexibility that can rapidly capitalize on rate divergence when it returns. This means structuring 2026 contracts with volume flexibility, maintaining spot market relationships, and ensuring your technology platform can quickly identify and exploit rate spread opportunities.

Rate convergence in European freight markets represents both challenge and opportunity for procurement professionals. Success requires abandoning fixed allocation models in favor of dynamic strategies supported by real-time market intelligence. The convergence won't last forever, but the procurement capabilities you build to navigate it will provide competitive advantages long after traditional rate spreads return.