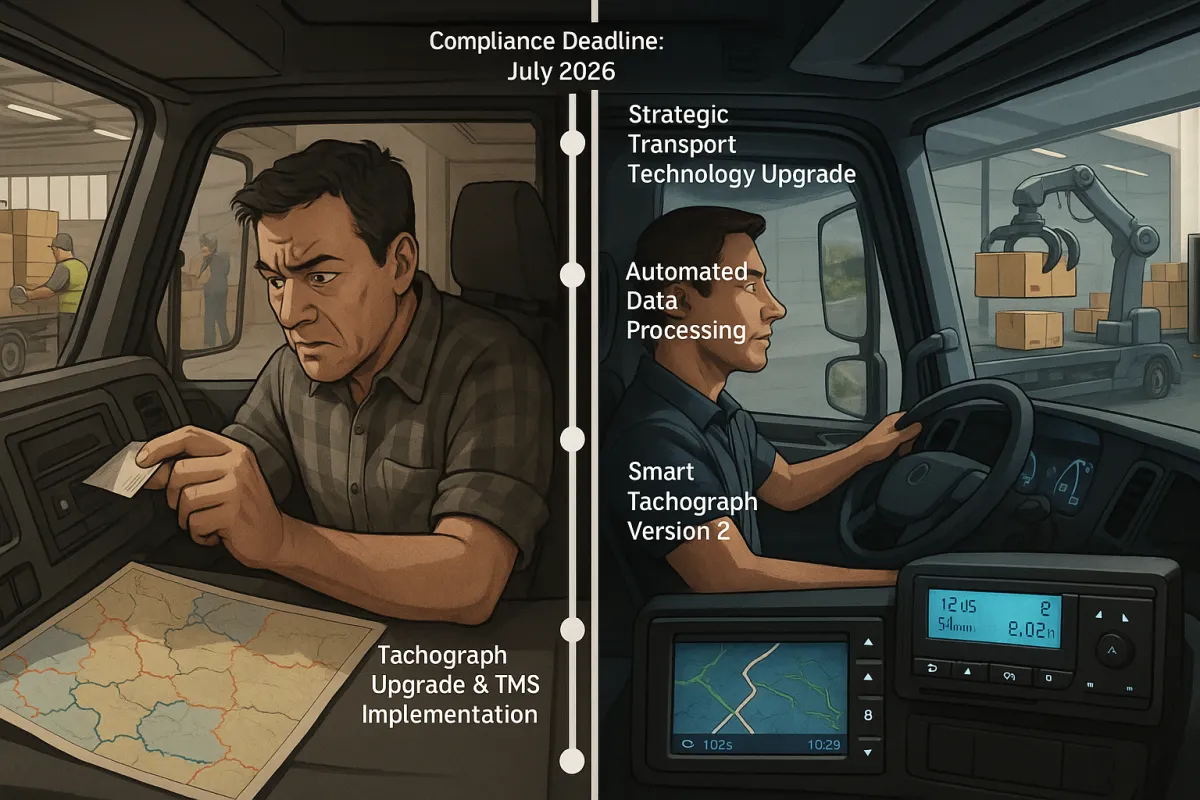

The European Shipper's Smart Tachograph 2 Roadmap: How to Turn August 2025's Compliance Deadline into a Strategic Transport Technology Upgrade

The August 19, 2025 Smart Tachograph Version 2 deadline just passed for heavy-duty vehicles in international transport. You handled the retrofit costs, managed workshop scheduling, and got your fleet compliant. But here's the problem most European shippers miss: treating the tachograph upgrade as an isolated compliance issue rather than the foundation for broader transport technology modernization.

Smart Tachograph Version 2 brought automatic border crossing recording, loading/unloading detection, and enhanced data transmission capabilities. Meanwhile, the European TMS market reached €1.4 billion in 2024 and is growing at 12.2% annually, driven by companies seeking integrated solutions that turn compliance data into operational intelligence.

The next compliance window creates your strategic opportunity. Light commercial vehicles over 2.5 tonnes require Smart Tachograph Version 2 by July 1, 2026, giving you 10 months to develop a coordinated approach that addresses both regulatory requirements and technology modernization in a single initiative.

The Hidden Costs of Fragmented Transport Technology

Most European shippers operate with disconnected systems. Your drivers manually download tachograph data weekly. Your transport managers input border crossing information into spreadsheets. Your procurement team negotiates carrier rates without real-time performance data. Your finance team reconciles invoices against incomplete delivery records.

Sound familiar? This fragmented approach creates hidden costs that compound over time. A German automotive supplier I worked with discovered they were paying €45,000 annually in overtime for manual data processing that modern integrated systems could automate. Their transport team spent 12 hours weekly reconciling tachograph downloads with delivery confirmations.

The Smart Tachograph Version 2's enhanced data capabilities offer automatic solutions to these manual processes. Version 2 records border crossings automatically and detects vehicle position during loading/unloading operations, eliminating much of the manual documentation that consumes your team's time.

The Integration Gap That Costs You Money

Your Smart Tachograph Version 2 generates rich operational data, but without proper TMS integration, that information sits isolated in driver cards and vehicle units. You're paying for compliance hardware without capturing the intelligence it creates.

Modern TMS platforms like Cargoson, alongside established solutions from Descartes and SAP TM, offer pre-built integrations that transform tachograph data into actionable insights. The difference? Instead of weekly manual downloads, you get real-time visibility into driver hours, route performance, and border crossing efficiency.

Your 6-Month Technology Modernization Roadmap

The July 2026 light commercial vehicle deadline creates the perfect timeline for strategic planning. TMS implementation costs range from €30,000 to €900,000, but coordinating this investment with your remaining tachograph upgrades can optimize both expenses and outcomes.

Months 1-2: Technology Audit and Requirements Planning

Start with a comprehensive audit of your current transport technology stack. Document all manual processes, data silos, and integration gaps. Calculate the true cost of your fragmented systems including staff time, delayed deliveries, and compliance risks.

Map your remaining light commercial vehicle fleet that requires Smart Tachograph Version 2. These vehicles represent your second wave of compliance investment and technology upgrade opportunity.

Months 3-4: Vendor Selection and Integration Architecture

Implementation costs that configure and connect the TMS correctly allow you to reap benefits for the next 10+ years. Focus on vendors offering comprehensive European carrier networks and proven tachograph data integration capabilities.

Evaluate TMS providers based on their Smart Tachograph Version 2 integration capabilities, not just standard transport management features. Solutions like nShift, Transporeon, and Cargoson offer different approaches to European carrier connectivity and compliance automation.

Months 5-6: Coordinated Implementation and Testing

Coordinate your TMS implementation with the light commercial vehicle tachograph installations. This parallel approach reduces total downtime and ensures your new technology stack works seamlessly from day one.

Test automated border crossing documentation, loading/unloading tracking, and real-time driver hours monitoring before full deployment. The enhanced capabilities of Smart Tachograph Version 2 enable automation that wasn't possible with previous systems.

The Carrier Connectivity Advantage

Smart Tachograph Version 2's data capabilities create new opportunities for carrier relationship management. Additional driver information can be transmitted to enforcement authorities through short-range communication, but the same data streams enable sophisticated carrier performance benchmarking.

Setting up carrier connections requires significant effort and cost, especially when working with multiple carriers. Some TMS solutions offer published APIs allowing external carriers to connect their systems. Others provide pre-built carrier networks that reduce implementation complexity.

Consider the total cost of carrier connectivity. Building individual API connections with 15-20 European carriers can cost €3,000-€5,000 per integration. TMS platforms with established carrier networks like Blue Yonder, Manhattan Active, and Cargoson reduce these costs significantly.

Cost Optimization Through Strategic Timing

The numbers work in your favor when you coordinate investments. The EU granted a two-month enforcement pause from January 1 to February 28, 2025, for companies unable to complete Smart Tachograph Version 2 retrofits by December 31, 2024. This flexibility demonstrates regulatory understanding of implementation challenges.

For light commercial vehicles, you have more time and better planning opportunities. Workshop capacity will be less constrained in early 2026 compared to the heavy-duty vehicle rush of late 2024 and early 2025.

Budget strategically by combining tachograph and TMS investments. A mid-sized European distributor with 200 light commercial vehicles faces €340,000-€440,000 in tachograph retrofit costs. Adding a properly integrated TMS might increase total investment to €500,000-€600,000, but the combined system delivers ROI through automated processes, improved carrier negotiations, and reduced administrative overhead.

The Procurement Intelligence Opportunity

Enhanced tachograph data enables more sophisticated transport procurement strategies. Automatic border crossing records provide precise transit time data. Loading/unloading location tracking validates carrier performance claims. Real-time driver hours monitoring ensures service reliability.

Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings. The key difference? Data-driven tender processes based on actual performance rather than carrier promises.

Use Smart Tachograph Version 2 data to benchmark carrier performance objectively. Border crossing delays, actual loading times, and route efficiency become measurable metrics for future contract negotiations.

Future-Proofing Beyond July 2026

Your technology modernization strategy should address upcoming regulatory changes beyond the light commercial vehicle deadline. The EU's eFTI regulation, ETS expansion to road transport, and evolving cross-border documentation requirements will create new compliance demands.

The Commission is required to adopt technical specifications for passenger transport data recording by November 23, 2025, indicating continued regulatory evolution in transport technology requirements.

Position your technology investments for long-term compliance flexibility. TMS platforms with strong European regulatory focus and automatic update capabilities will adapt to new requirements more efficiently than basic systems requiring manual configuration changes.

The Competitive Advantage Timeline

Companies completing integrated technology modernization by mid-2026 will operate with significant advantages over competitors managing disconnected systems. Real-time transport visibility, automated compliance reporting, and data-driven carrier relationships create operational efficiencies that compound over time.

The July 1, 2026 deadline marks the completion of Smart Tachograph Version 2 implementation across all commercial vehicles in international transport. Beyond this point, your competitive differentiation comes from how effectively you leverage the enhanced data capabilities for operational optimization.

Start planning your strategic roadmap now. The next 10 months represent your window to transform a compliance requirement into a comprehensive technology upgrade that positions your transport operations for sustained competitive advantage. Contact TMS vendors to assess integration capabilities, evaluate your light commercial vehicle upgrade timeline, and develop a coordinated implementation strategy that maximizes both compliance efficiency and operational ROI.