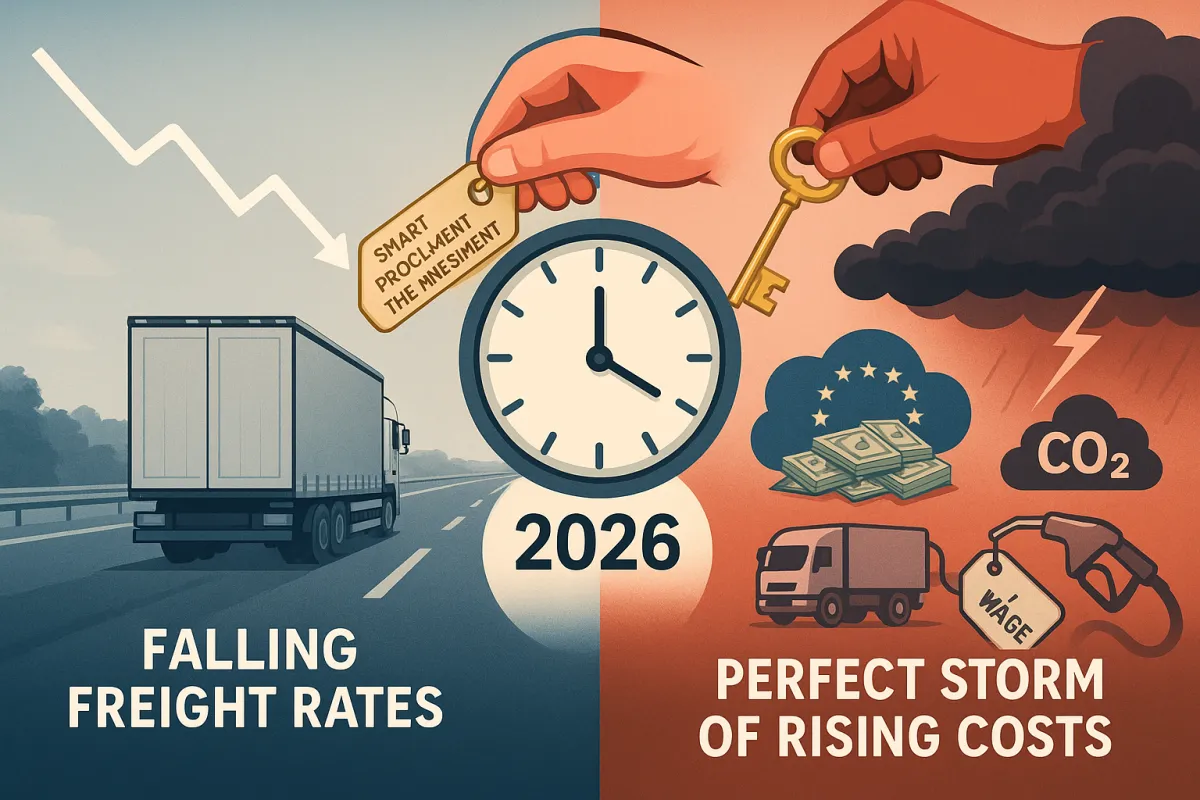

The European Shipper's Strategic Window: How Smart Procurement and TMS Investment Can Lock in Savings Before 2026's Perfect Storm of Rising Costs

The numbers tell a stark story: European road freight spot rates fell 3.8 points quarter-on-quarter to 134.1 points in Q1 2025, while contract rates dropped 2.3 points to 131.1. But before you celebrate these declining rates, consider what's building beneath the surface. The EU ETS expansion from 40% to 70% coverage in 2025 and the operating cost of an average bulk vessel could increase by €1.3 million annually in 2026 when full compliance kicks in.

This window of opportunity won't stay open. Smart European shippers with significant transport spend are already moving to optimize their procurement strategies and technology investments before the perfect storm hits in 2026.

The Deceptive Calm: Why 2025's Rate Decline Masks a Brewing Cost Storm

Consumer demand remains low, and the resumption of the trade war is weakening confidence in the industrial sector. Consumer spending in Europe has remained stagnant, increasing only 0.6% quarter-on-quarter, with 61% of households maintaining similar income, savings, and spending levels. This weak demand environment is what's driving current rate declines, not any fundamental improvement in capacity or cost structures.

Meanwhile, structural cost pressures keep mounting. Driver wages increased by 5.1% year-on-year for Spanish drivers conducting international operations, while in Italy, new agreements have led to wage increases of more than EUR 500 per month since the beginning of 2025. Heavy goods vehicle registrations fell by 16% between Q1 2024 and Q1 2025, constraining future capacity additions.

The real killer? Regulatory costs are accelerating faster than most procurement teams realize. The EU ETS phases from 40% coverage in 2024 to 70% in 2025, reaching 100% by 2026. Carriers have been steadily increasing surcharges, with Q2 2025 going +11% vs. Q1 2025 charges. When you factor in Denmark's system launching from January 2025 and Sweden's CO2 tolls starting in May, plus new CO2 standards for heavy trucks from July 2025, the cost trajectory becomes clear.

The Strategic Procurement Window: Securing Multi-Year Contracts While Rates Are Low

At the start of 2025, the level of demand has led to a balance of power favourable to shippers, but this advantage comes with a warning. The current balance of power remains fairly favourable to shippers, but it is prudent to ensure long-term capacity based on balanced partnerships with carriers, advises Thomas Larrieu, CEO of Upply.

This isn't about squeezing carriers until they bleed. The driver shortage crisis persists, with 426,000 unfilled truck driver jobs in Europe, and carriers face genuine cost inflation. The smart play is locking in multi-year agreements that acknowledge these realities while securing predictable pricing before regulatory costs explode.

Your tender strategy should focus on 2-3 year contracts with built-in cost sharing mechanisms for regulatory changes. Include specific clauses for ETS cost pass-through based on actual emissions data, not carrier estimates. Explore long-term contracts with carriers to lock in rates and share decarbonisation risks. This approach protects you from 2026's rate shock while giving carriers predictable revenue to invest in cleaner technology.

Consider segmenting your carrier portfolio more strategically. Reserve your best rates for core lanes with reliable partners who demonstrate genuine emission reduction efforts. Use spot markets for flexibility but don't depend on them for base volumes when lower volumes are expected to reduce pressure on road freight rates through 2025 reverses course.

Technology Investment: Why 2025 Is the Perfect Time for TMS Implementation

The European TMS market is experiencing unprecedented growth. Growing at a CAGR of 12.1%, the market value of transport management systems in Europe is forecasted to reach €2.1 billion in 2028, up from around €1.2 billion in 2023. More importantly, Software-as-a-Service (SaaS)-based TMS is becoming more popular because the SaaS delivery model is flexible and costs less, making up a big part of the global TMS market.

What makes 2025 the ideal timing? Three factors converge: regulatory complexity is increasing faster than internal capabilities can adapt, rate volatility demands more sophisticated optimization, and cloud-based solutions have finally matured for mid-market European companies.

German exporters integrate CO₂ calculators into tendering engines, French retailers deploy multimodal TMS to cut congestion charges, and UK shippers post-Brexit need advanced customs screening. These aren't nice-to-have features anymore. They're operational necessities for managing the regulatory tsunami ahead.

The vendor landscape offers compelling options across different needs. Established players like SAP TM, Oracle TM, and Manhattan Active TM provide enterprise-grade functionality for large operations. MercuryGate, Descartes, and Alpega offer strong mid-market solutions with European focus. For companies seeking modern, API-first architecture with strong European compliance features, Cargoson provides cloud-native TMS designed specifically for European supply chain requirements.

Implementation timelines matter. A Q2 2025 go-live gives you 6-9 months to optimize before regulatory costs spike. Wait until 2026, and you're implementing during crisis mode when carrier relationships and budget pressures intensify.

Regulatory Cost Mitigation: Preparing for the 2026 ETS and CO2 Toll Expansion

The numbers are staggering. The operating cost of an average bulk vessel trading within the EU could increase by €1.3 million annually in 2026 when shipping companies will be required to submit allowances for 100% of their verified CO₂ emissions, with no more partial exemptions.

For road transport, the picture is equally challenging. According to Deutsche Bank, the EU carbon price should range between 60 and 150 € in 2026, depending on market conditions, up from current levels around €65-€90 per metric ton. Starting in 2026, the EU ETS will expand to include methane and nitrous oxide from June onwards, hitting LNG-powered vessels particularly hard.

Your mitigation strategy needs multiple layers. First, invest in emissions verification tools. Use tools like Searoutes' Freight Emissions Reporter to verify EU ETS emissions calculations and ensure they align with actual emissions and EUA costs. Too many shippers are paying inflated surcharges because they can't verify carrier calculations.

Second, optimize your modal mix. Consider multimodal transport (e.g., rail or short-sea shipping) to reduce reliance on high-emission voyages. The China-Europe rail option, taking 12-18 days versus 30-40 by sea, becomes more attractive when you factor in ETS avoidance.

Third, prepare for the expanding CO2 toll network. Denmark's system will be up and running from January 2025, with the Netherlands thinking of 2026, as well as Romania. Lithuania (2024), Denmark (2025), the Netherlands and Romania (both 2026) will switch from time- to distance-based tolling systems, with Denmark and the Netherlands having already passed laws to introduce CO2-based tolling systems.

Capacity Securing Strategies: Building Resilient Carrier Networks

The capacity crunch is real and worsening. Heavy goods vehicle registrations fell by 16% between Q1 2024 and Q1 2025, while battery-electric truck registrations grew by 51% year-on-year to reach a 3.5% market share. This transition creates a temporary capacity shortage as older diesel trucks exit faster than electric replacements arrive.

In Italy, new agreements have led to wage increases of more than EUR 500 per month since the beginning of 2025, following 4% year-on-year labour cost increases across the EU in Q4 2024. These wage pressures aren't subsiding and will force further capacity consolidation among smaller operators who can't absorb the costs.

Your carrier network strategy should prioritize diversification across three dimensions: geographic coverage, asset types, and technology adoption levels. Don't concentrate too much volume with carriers who haven't started their decarbonization journey. They'll face the steepest cost increases and highest bankruptcy risk as regulations tighten.

Identify carriers investing in cleaner technologies and operational efficiency. These partners will have competitive advantages as carbon pricing intensifies. Develop deeper partnerships with 3-5 strategic carriers while maintaining a broader network of 15-20 tactical providers for flexibility.

Consider co-investment opportunities. Some forward-thinking shippers are providing capital or guaranteed volumes to help preferred carriers invest in electric trucks or cleaner technology. This secures preferential capacity allocation while supporting mutual decarbonization goals.

Mode Optimization and Alternative Routes: Tactical Flexibility for Cost Control

Modal flexibility becomes a competitive advantage when regulatory costs vary by transport mode. Rail freight offers significant ETS savings for appropriate cargo types. The China-Europe rail network, delivering in 12-18 days versus 30-40 by sea, provides a middle option between expensive air freight and increasingly carbon-taxed ocean transport.

Within Europe, expanding rail connections between major industrial centers offer alternatives to road transport on high-volume lanes. The challenge is typically first-mile and last-mile connectivity, where collaboration with other shippers can create consolidation opportunities.

Short-sea shipping and inland waterways represent underutilized options for bulk and containerized cargo. These modes face lower ETS burden due to higher cargo-to-emission ratios compared to trucking. The key is understanding when transit time flexibility allows modal substitution.

Consolidation strategies deserve renewed attention. Uber Freight launched an AI logistics network comprising 30 autonomous agents, processing USD 1.6 billion in freight for clients including Colgate-Palmolive. Similar approaches can help mid-size shippers achieve economies of scale traditionally available only to larger players.

Your mode optimization should integrate with TMS capabilities for dynamic decision-making. When spot road rates spike due to capacity constraints or regulatory events, automated systems can evaluate rail or intermodal alternatives based on total cost and service requirements.

Implementation Roadmap: Your 90-Day Action Plan

Month 1: Market Analysis and Tender Preparation

Conduct a comprehensive spend analysis across your European transport network. Map current carrier relationships, contract expiration dates, and regulatory exposure by lane. Quantify your ETS and CO2 toll exposure for 2025 and projected 2026 costs. This baseline analysis informs all subsequent decisions.

Begin RFP preparation for both carrier tenders and TMS selection. Include specific requirements for emissions reporting, regulatory compliance tracking, and multi-year pricing structures with cost adjustment mechanisms.

Month 2: TMS Selection and Contract Negotiations

Complete TMS vendor evaluation and selection. Consider established players like SAP, Oracle, and Manhattan for large enterprises; MercuryGate, Descartes, and Alpega for mid-market needs; and modern solutions like Cargoson for API-first architecture with strong European compliance features.

Launch carrier tender process with extended contract terms (2-3 years) and clear regulatory cost-sharing mechanisms. Negotiate preferential capacity allocation in exchange for volume commitments and longer contract terms.

Month 3: Implementation and Monitoring Setup

Begin TMS implementation with focus on emissions tracking and regulatory reporting capabilities. Establish KPIs that track both cost performance and regulatory compliance. Key metrics include: emissions per ton-kilometer by mode and carrier, regulatory surcharge accuracy and trend analysis, capacity utilization rates, and contract compliance performance.

Set up monthly reviews combining operational performance with regulatory cost tracking. This creates early warning system for rate changes and capacity constraints before they impact service levels.

The companies moving first will secure the best carrier partnerships and technology platforms before demand spikes. Those waiting until 2026 will implement during crisis mode with limited options and higher costs. The choice is clear: act now while you have negotiating power, or react later from a position of weakness.