The European Shipper's Strategic Window: How to Lock in Transport Cost Savings Before the 426,000 Driver Shortage Forces Rates Back Up

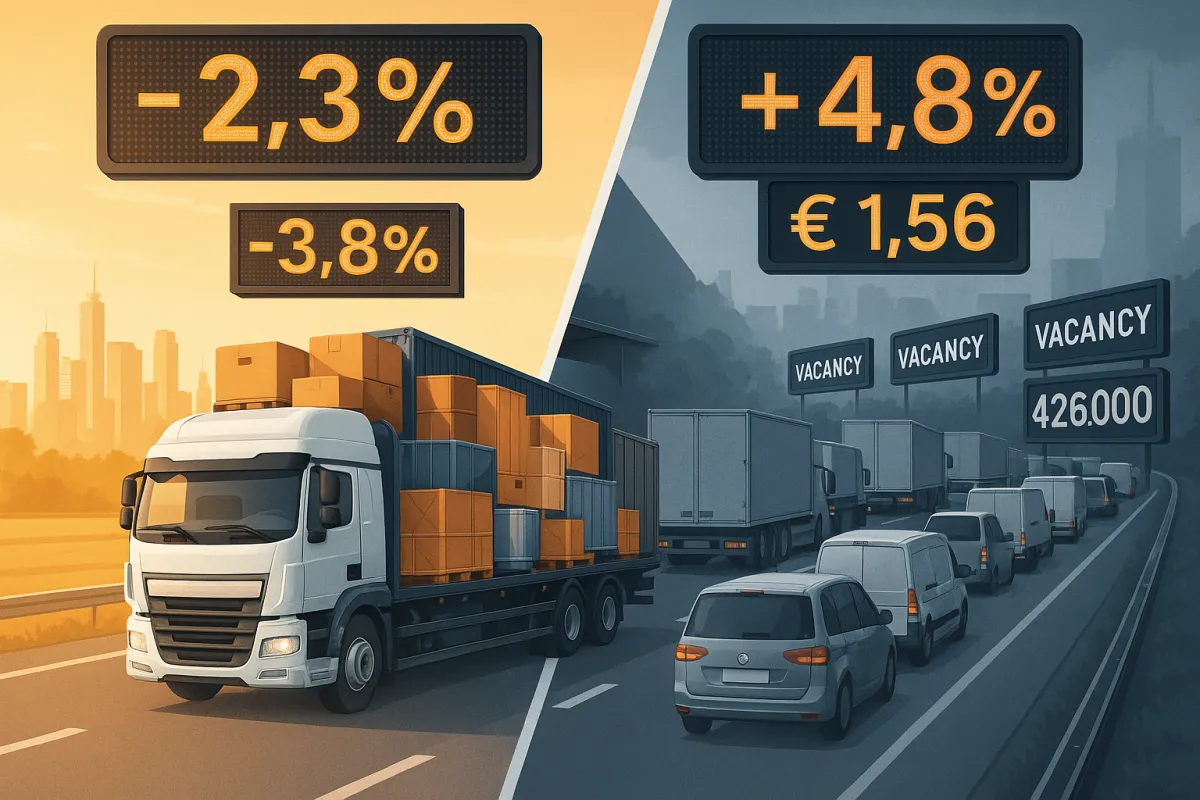

European shippers face a unique window of opportunity in 2025. Contract rates dropped 2.3 points and spot rates fell 3.8 points quarter-on-quarter in Q1 2025, while 426,000 truck driver positions remain unfilled across Europe. This creates an unusual paradox: transport cost management becomes easier in the short term, but the underlying capacity crisis threatens to drive rates sharply higher within 12-18 months.

The question isn't whether rates will rise again—it's when. Smart shippers are using this temporary advantage to build strategic partnerships and lock in favorable terms before the driver shortage forces the market to flip back in carriers' favor.

The Current Transport Cost Paradox: Low Rates Meet Capacity Crisis

European road freight rates declined across most corridors and markets in Q1 2025 due to weak consumer demand, high but stabilizing costs, and geopolitical uncertainty. The numbers tell a clear story: the level of demand has led to a balance of power favorable to shippers, faced with carriers who are heading into the year with a high cost base.

But this surface-level rate environment masks serious structural problems. Diesel prices increased 4.8% quarter-on-quarter, and driver wages are rising—Spanish international drivers saw 5.1% year-on-year increases, while Italian drivers received over €500 monthly increases since early 2025.

Perhaps most telling: heavy goods vehicle registrations fell 16% between Q1 2024 and Q1 2025, indicating carriers are reluctant to expand capacity despite apparent demand. They know what's coming.

Regional variations add complexity to the picture. Poland-Germany routes showed resilience, with the Warsaw-Duisburg contract rate index remaining significantly higher year-on-year (+7.3%), suggesting that high-volume corridors with established demand patterns offer more stability for both rates and capacity allocation.

Understanding the Forces Behind Today's Rate Environment

Several economic factors converge to create this shipper-favorable moment. Consumer spending increased only 0.6% quarter-on-quarter, with 74% of consumers reporting trading down by buying less or choosing cheaper retailers. This demand weakness gives shippers negotiating power they haven't enjoyed in years.

Trade tensions compound the effect. As global uncertainty persists, European businesses are pivoting toward regionalization, which could lead to acceleration of offshoring and boost demand for road transport. The "Buy European" movement might provide medium-term rate support, but in the short term, tariff uncertainty keeps volumes unpredictable.

Cost pressures build beneath the surface. Costs remain elevated due to regulatory and environmental changes, including the Eurovignette Directive implementing additional CO2-based road tolls and the ETS II beginning in 2027. Toll increases reached 7.4% in Austria, 40% in Hungary, and 13% in the Czech Republic due to CO2-based changes.

The Poland, Germany, France corridor analysis reveals how different markets respond to these pressures. Trade volumes along major road corridors began recovering in early 2025, with Germany posting 1.0% industrial production growth, Poland 0.7%, and France 0.5%, though volumes remain below year-ago levels.

The Strategic Opportunity: Building Long-term Partnerships Now

This rate environment creates ideal conditions for securing multi-year partnerships. Carriers need volume commitments and cash flow predictability more than premium rates right now. "The current balance of power remains fairly favorable to shippers, but it is prudent to ensure long-term capacity based on balanced partnerships with carriers," warns Thomas Larrieu, CEO of Upply.

The key is structuring partnerships that work for both parties long-term. Successful agreements balance volume commitments against rate guarantees, often using indexed pricing mechanisms that protect carriers from fuel and regulatory cost increases while giving shippers predictable baseline costs.

Consider how capacity allocation becomes critical. Businesses will increasingly blend contracts for baseline capacity, using spot rates for flexibility, as uncertainty could dampen contract market impact and amplify spot market pressure. Smart shippers are securing 60-70% of their capacity through contracts while maintaining spot market flexibility for peaks and seasonal variations.

Technology plays an enabling role here. Companies using comprehensive transport management systems—whether from established providers like SAP TM, Oracle TM, MercuryGate, Descartes, or newer solutions like Cargoson—can provide carriers with better load planning, route optimization, and payment certainty. This operational partnership approach builds stickier relationships than pure price negotiations.

Contract Negotiation Strategies for the Current Environment

Index-linked fuel surcharges become non-negotiable in long-term agreements. With diesel volatility expected to continue, fixed-price contracts expose carriers to unacceptable risk. Successful agreements typically use weekly diesel price indices with 2-week lag adjustments, providing stability while sharing risk appropriately.

Dynamic pricing mechanisms allow rates to adjust for regulatory changes like CO2 tolling. Rather than renegotiating contracts every time new environmental rules take effect, build automatic adjustment clauses based on documented cost increases from regulatory compliance.

Volume commitments require careful balance. Too high, and you lose flexibility during demand downturns. Too low, and carriers won't prioritize your freight when capacity tightens. The sweet spot often sits at 80% of expected annual volume, with penalty structures that encourage performance rather than punish market fluctuations.

Regional capacity allocation strategies matter more in Europe's fragmented market. Securing dedicated capacity on high-volume corridors (Germany-France, Poland-Germany) while maintaining flexibility on secondary routes gives you the best of both worlds.

Cost Optimization Tactics That Work in 2025's Market Conditions

Load optimization and network efficiency strategies deliver immediate results in the current environment. Collaborative freight consolidation programs—sharing truck space with non-competing shippers—can reduce costs by 15-25% while providing carriers with fuller loads and better route utilization.

Cross-docking operations become more viable when rates are favorable. The initial setup costs look more attractive when you can secure attractive transport rates for the next 2-3 years. This creates operational flexibility while reducing total transport spend.

Alternative transport modes deserve fresh evaluation. Rail freight traffic is expected to double by 2050 as part of sustainability initiatives, but current rail capacity constraints mean securing rail slots now, while rates are still reasonable, positions you ahead of the capacity crunch.

Digital tools for route optimization and carrier selection provide competitive advantages. Advanced TMS platforms now offer AI-powered load matching and predictive analytics that help optimize both costs and service levels. Whether you choose enterprise solutions like Manhattan Active TM, Oracle Transportation Management, or more specialized platforms like Descartes or Cargoson, the key is implementing tools that provide real-time visibility and decision support.

Practical Implementation: The 90-Day Action Plan

Immediate steps (0-30 days): Audit your current transport spend and capacity allocation. Identify which routes and carriers account for the highest volumes and costs. Document current contract terms and expiration dates. Most importantly, calculate your actual spot vs. contract ratio—many companies discover they're more exposed to spot market volatility than they realize.

30-60 day activities: Begin renegotiating expiring contracts with an emphasis on longer terms and partnership elements. Diversify your carrier base by identifying 2-3 new carriers for each major route. Start capacity trials with alternative providers while rates are favorable.

60-90 day goals: Implement monitoring systems that track rate movements, carrier performance, and cost drivers in real-time. Establish KPIs that balance cost optimization with service reliability. Create escalation procedures for capacity shortages—because they're coming.

Preparing for the Capacity Crunch: What's Coming Next

The driver shortage escalation timeline is predictable. The number of unfilled driver positions in Europe surged to 426,000, up significantly from 233,000 in 2023. Over 30% of drivers across Europe are now over 55, with 17% of Europe's current driver population expected to retire by 2029.

Regional impacts vary significantly. Young drivers under 25 make up just 6.5% of the workforce, with critically low rates in Italy (2.2%), Germany (2.6%), Poland (3%), and Spain (3%). These demographics suggest Germany and Italy will face the most severe capacity constraints first.

Historical patterns show how capacity shortages affect pricing. During previous driver shortage peaks, rates increased 20-30% within 6-12 months once demand returned. Despite relatively weak demand, 2025 rates will continue on a moderate upward trend, mostly due to constrained capacity and rising costs.

Sustainability regulations add further pressure. The ETS II begins in 2027, increasing fossil fuel prices, while new CO2 standards for heavy trucks from July 2025 will require lower emissions, raising manufacturing costs. These aren't one-time adjustments—they represent permanent increases to the cost base.

Building operational resilience requires more than just securing capacity. Develop contingency plans for different shortage scenarios. Create load prioritization systems that ensure critical shipments move even when capacity becomes scarce. Build relationships with logistics service providers who can offer temporary capacity during peak shortage periods.

Technology and Data: Your Competitive Advantage

Transport management systems become critical decision-making tools when capacity becomes scarce. Advanced TMS platforms provide predictive analytics that help forecast rate movements and capacity constraints before they impact your operations. Transportation capacity management is not just a tool for efficiency but a strategic asset for strengthening carrier-shipper relationships, helping build trust, enhance collaboration, and achieve cost efficiencies.

Data analytics for predicting rate movements rely on combining internal shipping data with external market intelligence. Successful companies monitor fuel price trends, driver wage inflation, regulatory compliance costs, and carrier financial health to anticipate rate changes 60-90 days ahead of the market.

Digital freight exchanges and capacity optimization platforms provide access to spot capacity during shortage periods, but they work best as supplements to core carrier relationships rather than replacements. The key is having multiple capacity sources activated and ready before you need them.

Integration with existing ERP and planning systems ensures transport decisions align with broader business objectives. Whether you use SAP, Oracle, Microsoft Dynamics, or other enterprise systems, seamless data flow between planning, procurement, and transport management prevents costly silos and delays.

Major TMS vendors are adapting to these market conditions with enhanced features. SAP Transportation Management, Oracle TM Cloud, Manhattan Active Transportation, MercuryGate, Descartes, and emerging platforms like Cargoson all offer different approaches to capacity management and carrier collaboration. The choice depends on your integration requirements, user base, and specific functionality needs, but the key is implementing something rather than managing transport relationships through spreadsheets and phone calls.

The window for strategic advantage is narrowing. Economic trends point to gradually improving demand conditions, with euro area economic activity expected to expand 0.2% across the first three quarters of 2025 and household spending forecast to increase 1.4% year-on-year. When demand returns and meets constrained capacity, today's favorable rate environment will reverse quickly.

Smart shippers are using this temporary market imbalance to build strategic partnerships, implement better technology, and create operational resilience. The companies that secure long-term capacity agreements and optimize their transport operations now will maintain competitive advantage when the capacity crunch inevitably arrives.

Your next move: audit your current transport spend, identify critical capacity needs, and start building partnerships that will survive the coming capacity crisis. The question isn't whether rates will rise—it's whether you'll be prepared when they do.