The European Shipper's TMS Security Feature Comparison: How to Evaluate Cargo Theft Protection Capabilities Across Vendors Before Criminal Sophistication Outpaces Your Defenses

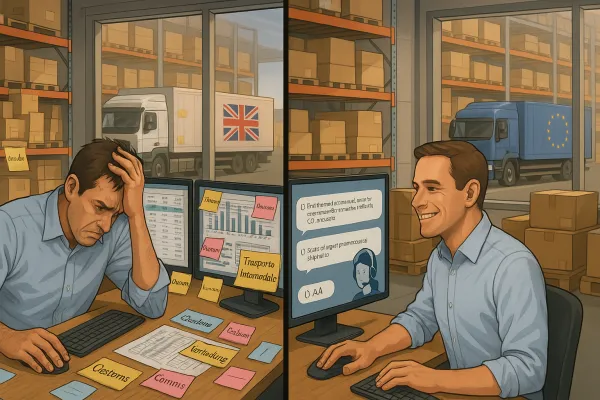

When criminals stole 1,736 loads in July 2024 alone across Europe, you probably weren't evaluating your TMS vendor's security features. You were likely dealing with the immediate chaos of missing shipments, angry customers, and insurance claims. But here's the uncomfortable truth: cargo crime costs businesses over €8.2 billion annually across the continent, and your transport management system either helps protect against these threats or becomes an entry point for increasingly sophisticated criminals.

The European cargo theft landscape has fundamentally changed. Highly organised criminals are planning and executing sophisticated deceptions and fraud, using impersonation, advanced AI to alter bills of lading, and remote access. These aren't opportunistic truck stop thieves anymore - they're organized crime groups that run sophisticated operations mirroring the efficiency of the businesses they target, employing industry insiders, leveraging real-time shipment data, and carefully selecting high-value targets.

Your TMS security features aren't just about protecting data anymore. They're about preventing €532,000 worth of goods stolen daily and keeping your supply chain operational when criminals target everything from electronics to pharmaceuticals.

The €8.2 Billion Wake-Up Call: Why TMS Security Features Have Become Mission-Critical

The numbers tell a story that most supply chain directors haven't fully grasped yet. Cargo theft across Europe has soared 438% in three years, but the real shock is how these criminals operate. Strategic cargo theft and organised crime now account for around 18% of all thefts in the United States, with criminals using fraudulent documentation to pick up cargo, hacking into regulatory accounts to arrange fictitious pickups, and employing disguises. Similar trends are emerging in the United Kingdom, Germany, France and elsewhere in Europe.

The €16.2 million stolen in July 2024 alone represents only 5.1 per cent of incident reports that included a financial loss value, meaning the real damage could be up to 20 times higher. When the average loss for each reported cargo theft is around €186,000, a single successful attack can wipe out months of transport cost optimization.

What makes this particularly relevant to your TMS procurement decision is how criminals exploit digital vulnerabilities. Europe has seen a rise in technologically sophisticated thefts, as criminals increasingly exploit technological vulnerabilities to bypass traditional security measures. Your transport management system isn't just processing shipments - it's potentially broadcasting valuable cargo information to anyone who can access it.

Major TMS vendors like Oracle TM, SAP TM, and emerging European players like Cargoson have responded by developing advanced security features specifically targeting these new threat patterns. But not all security implementations are created equal, and the wrong choice could leave you exposed to exactly the threats you're trying to prevent.

The Five Essential TMS Security Feature Categories Every European Shipper Must Evaluate

When evaluating TMS security features, focus on these five critical areas that directly address current European cargo theft patterns:

Real-Time Tracking with Anti-Tampering Technology

GPS and real-time visibility technology create visibility to shipments in transit and can be leveraged to send notifications when shipments veer off the desired route, experience unusual delays, or experience other anomalies that may indicate cargo theft. In the case of suspected theft or delay, shippers can swiftly communicate the shipment location to law enforcement. Modern TMS platforms integrate with IoT sensors and tracking devices, but the key differentiator is anti-jamming technology and encrypted communication protocols.

Look for systems that maintain tracking capability even when GPS signals are blocked or compromised. The best platforms use multiple data sources - cellular triangulation, WiFi positioning, and accelerometer data - to maintain visibility when primary tracking methods fail.

Geofencing and Route Deviation Detection

Since nearly half (40%) of all thefts take place at unsecured roadside parking and rest areas, your TMS needs sophisticated geofencing capabilities. This isn't just about drawing circles on maps - advanced systems use machine learning to understand normal vs. suspicious routing patterns and can distinguish between legitimate stops and potential theft scenarios.

The most effective implementations combine geofencing with historical route analysis, automatically flagging deviations that don't match typical driver behavior patterns or known secure stopping points.

Digital Identity Verification and Carrier Authentication

With fraudulent carriers, identity deception, cyber-enabled scams and insider collusion emerging as key strategies used by cargo criminals, your TMS must verify carrier legitimacy before load assignment. Look for systems that integrate with government databases, check commercial insurance status in real-time, and maintain audit trails of carrier verification steps.

Advanced platforms use multi-factor authentication for carrier portals and require periodic re-verification of credentials, licenses, and insurance coverage.

Cybersecurity Controls and Access Management

Authentication measures, such as two-factor authentication (2FA), add an extra layer of security by requiring users to provide two pieces of evidence to verify their identity. This can include something they know (e.g., a password) and something they possess (e.g., a unique code sent to their mobile device). By implementing 2FA, you significantly reduce the risk of unauthorised access.

Enterprise-grade TMS platforms should offer role-based access controls, session monitoring, and automated logout procedures. Oracle and SAP provide the most rigorous security environments, but modern European platforms are rapidly catching up with cloud-native security architectures.

Integration with Security Hardware and Law Enforcement Systems

The most sophisticated TMS platforms integrate with electronic seals, tamper-evident devices, and even law enforcement databases. Some systems can automatically alert authorities when specific theft indicators are detected, though this capability varies significantly by region and vendor.

Look for platforms that support multiple hardware vendors and can aggregate security data from various sources into a single dashboard.

Vendor-by-Vendor Security Capability Analysis: What Each Major TMS Provider Actually Delivers

Here's how major TMS vendors address security requirements, based on current implementations and customer feedback:

Oracle Transportation Management (OTM)

Oracle's enterprise approach focuses on comprehensive data protection and regulatory compliance. Their security infrastructure employs specialists that include some of the world's foremost experts in information, application, and network security. OTM provides robust encryption, detailed audit trails, and integration with Oracle's identity management systems.

The platform excels at regulatory compliance across multiple jurisdictions but can be complex to configure for specific security policies. Implementation typically requires 6-12 months, making rapid security updates challenging.

SAP Transportation Management (TM)

SAP TM typically includes comprehensive support in enterprise contracts, with integrated cybersecurity modules and compliance features. The platform offers strong authentication controls and detailed permission management, particularly effective for companies already using SAP ERP systems.

SAP's security strength lies in its integration capabilities and mature permission structures, but the platform can be inflexible when addressing rapidly evolving threat patterns.

MercuryGate (now Infios)

Their TMS is built with robust security, holding ISO 27001, SOC 1 Type 2 and SOC 2 Type 2 compliance certifications, employing a best-of-breed security approach to safeguard customer data. MercuryGate focuses on carrier verification and real-time tracking capabilities, with strong North American carrier network security but more limited European-specific features.

The platform provides solid foundational security but may require additional integrations for advanced threat detection capabilities.

Cargoson

As a European-focused platform, Cargoson addresses region-specific security challenges including GDPR compliance and European cross-border verification requirements. The platform includes implementation support in pricing models and focuses exclusively on shippers rather than carriers or 3PLs.

Their modern architecture allows for rapid security updates and integrates with European law enforcement databases. The platform emphasizes API-based security rather than traditional EDI approaches.

Blue Yonder

Blue Yonder specializes in predictive logistics and uses AI to calculate more accurate delivery windows. Their security approach focuses on predictive threat detection, using machine learning to identify unusual patterns that might indicate security breaches.

The platform's AI capabilities can predict potential security risks based on route patterns, carrier behavior, and historical data, though this requires significant data to achieve accuracy.

The Hidden Security Gaps in Popular TMS Platforms (And How to Spot Them)

Even well-regarded TMS platforms have security vulnerabilities that criminals actively exploit. Understanding these gaps helps you evaluate vendors more critically:

Carrier Onboarding Weak Points

Most TMS platforms allow carriers to self-register through online portals. The problem? Many providers don't build custom integrations themselves but provide standard EDI interfaces that carriers must implement. This creates verification gaps where fraudulent carriers can appear legitimate by completing technical integration steps without proper business verification.

Look for platforms that require multi-step carrier verification including insurance validation, reference checks, and periodic re-certification. Avoid systems that rely solely on carrier-provided documentation.

Mobile App and Driver Interface Vulnerabilities

Driver mobile apps often become the weakest link in TMS security. Many platforms provide basic apps with minimal authentication, allowing anyone with login credentials to access shipment information and update delivery status.

Criminals exploit these apps by obtaining driver credentials through phishing or social engineering, then use legitimate access to gather intelligence about high-value shipments and delivery schedules.

Third-Party Integration Risks

Some TMS providers offer published APIs for carrier integration, but carriers may charge shippers for establishing these connections. While carriers can easily join platforms through portals, requesting completely new carrier API/EDI integrations is complex and costly.

These integration points create potential security vulnerabilities, especially when third-party systems don't maintain the same security standards as your primary TMS platform.

Red flags during vendor evaluations include reluctance to discuss specific security certifications, vague answers about data encryption methods, and inability to demonstrate integration with law enforcement systems or security hardware.

Advanced Security Features That Separate Leading TMS Vendors from the Pack

The most sophisticated TMS platforms offer security capabilities that go far beyond basic tracking and access controls:

AI-Powered Anomaly Detection

By applying machine learning to historical data and trends, transportation management systems are able to identify at-risk shipments and provide more accurate and informed recommendations, such as alternate delivery routes during high traffic periods.

Advanced systems analyze thousands of data points - route patterns, timing, carrier behavior, cargo values, and external factors like traffic and weather - to identify potential security risks before they become actual threats. For example, Cargoson's platform can automatically flag shipments that deviate from normal patterns, while Oracle's system integrates with broader supply chain data for comprehensive risk assessment.

Blockchain Integration for Tamper-Proof Documentation

Blockchain enhances freight management by increasing security and transparency. TMS solutions leveraging blockchain securely trace shipments, simplify record-keeping, and strengthen trust through clear, tamper-proof documentation.

Leading platforms like Oracle TM and Cargoson implement blockchain differently - Oracle focuses on comprehensive supply chain documentation, while newer platforms use blockchain specifically for high-value shipment verification and chain of custody tracking.

Real-Time Law Enforcement Collaboration

Some advanced TMS platforms maintain direct connections with law enforcement databases and can automatically share shipment data when thefts are reported. This capability varies significantly by region - European platforms often have better integration with local authorities than their American counterparts.

Look for systems that can provide law enforcement with real-time tracking data, shipment manifests, and carrier verification information without manual intervention.

Multi-Layer Authentication and Zero-Trust Architecture

The most secure TMS implementations assume every access request is potentially malicious. By encrypting data, you render it unreadable to unauthorised individuals, even if they manage to gain access. Implementing strong encryption algorithms and secure key management practices ensures data remains protected both at rest and during transit.

Advanced platforms require continuous verification, not just initial login authentication, and can detect unusual access patterns that might indicate compromised accounts.

The TMS Security Procurement Framework: Evaluation Criteria and Vendor Questions

Use this framework to systematically evaluate TMS security capabilities across vendors:

Security Requirement Scoring Matrix

Weight these criteria based on your specific risk profile: Real-time tracking accuracy (25%), carrier verification thoroughness (20%), cybersecurity controls (20%), integration capabilities (15%), incident response speed (10%), compliance coverage (10%).

Score each vendor 1-5 in each category, then calculate weighted totals. This approach prevents impressive-sounding features from masking fundamental security weaknesses.

Critical Vendor Questions

Ask specific questions that reveal actual security implementation: "What happens when GPS tracking fails?" "How do you verify new carrier legitimacy?" "Can you demonstrate automatic law enforcement notification?" "What data remains encrypted during normal operations?"

Pay attention to answers that reference specific technologies vs. vague security promises. Vendors with robust security can demonstrate features and explain technical implementation details.

Future-Proofing Your Security Investment

Evaluate vendor security roadmaps carefully. European shippers working with Cargoson or similar modern platforms access innovations immediately, while companies on legacy Oracle TM or SAP TM face lengthy upgrade cycles and additional licensing costs.

Look for platforms that can implement new security features without major upgrades or additional licensing fees. Cloud-based systems typically offer faster security updates than on-premise implementations.

Implementation Strategy: Rolling Out TMS Security Features Without Disrupting Operations

The most successful TMS security implementations follow a phased approach that builds confidence while minimizing operational disruption:

Start with High-Value Routes

Begin with lanes carrying your highest-value cargo or routes with historical theft problems. The most successful migrations follow a phased approach: pilot with one major lane, measure results carefully, then expand systematically. This approach lets you validate security features under real conditions while limiting initial risk exposure.

Document specific security improvements - faster theft detection, improved carrier verification, reduced false alarms - that justify expanding the implementation.

Train Teams on New Security Capabilities

Your dispatch and security teams need specific training on new TMS security features. Many implementations fail because users don't understand how to respond to security alerts or interpret risk indicators.

Create response procedures for different alert types, ensure 24/7 coverage for critical security notifications, and establish clear escalation paths for potential theft situations.

Measure Security ROI

Track quantifiable security improvements: reduction in theft incidents, faster recovery times for stolen goods, improved carrier performance, and decreased insurance claims. Track cost savings, efficiency improvements, and user satisfaction metrics. These data points justify expanded deployment and demonstrate ROI to stakeholders.

Remember that prevented losses are often invisible - the shipment that wasn't stolen because criminals saw active tracking, or the fraudulent carrier that was blocked during verification.

The reality is that cargo theft will continue evolving, but your TMS security features determine whether criminals see your shipments as easy targets or move on to less protected opportunities. Current favorable European transport market conditions make this an optimal time to negotiate better platform terms and carrier partnerships, including security requirements that protect your operations and improve competitive positioning.

Choose a TMS vendor that treats security as an ongoing competitive advantage, not just a compliance checkbox. Your supply chain resilience depends on it.