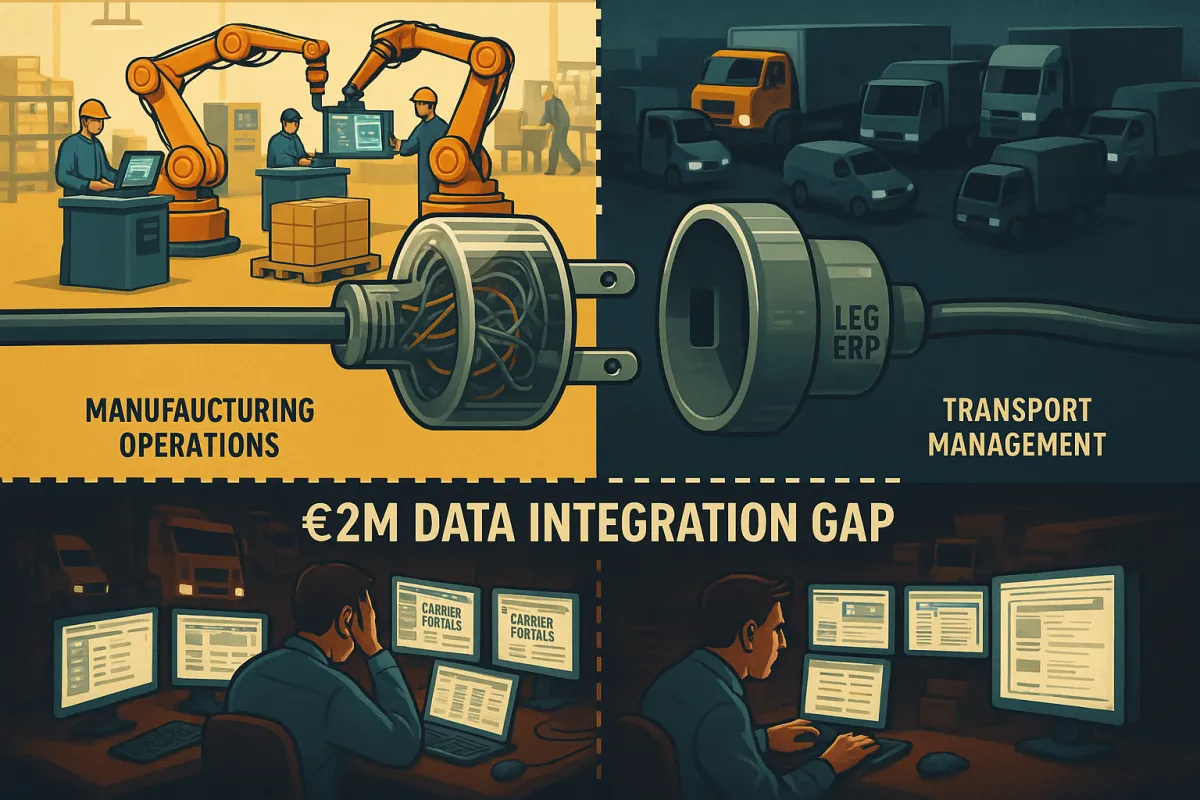

The €2M Data Integration Gap: How European Manufacturers Can Finally Connect Their TMS and Legacy ERP Systems for Complete Supply Chain Visibility

Your European transport operations run on disconnected systems. ERP for ordering, WMS for warehousing, separate carrier portals for booking, and manual processes scattered across departments. Data quality issues between your TMS and existing systems can undermine the entire process. After speaking with hundreds of European manufacturers over the past year, the pattern is clear: In 2024, Germany's manufacturing sector contributed 19.7% to the country's gross value added, yet many companies still struggle with fragmented data flowing between their transport management and enterprise systems.

The Europe ERP Software Market size was valued at USD 30.82 billion in 2024 and is projected to grow to USD 36.35 billion by 2025. Despite this massive investment, the integration gap between TMS and legacy ERP systems continues to prevent manufacturers from capturing the full value of their digital transformation initiatives. 47% of European manufacturing enterprises use ERP systems, but most operate in isolation from their transport management processes.

The Hidden Cost of Disconnected Systems

Many companies operate with disconnected systems - ERP for ordering, WMS for warehousing, separate carrier portals for booking, and manual processes for documentation. This fragmentation creates invisible costs that compound over time. A mid-sized German automotive parts manufacturer discovered this reality when they calculated their true cost of manual data re-entry: €2.1 million annually across transport operations alone.

The problem runs deeper than most CFOs realize. Many branded legacy ERP systems like DTR or Forth Shift were first created in the 1980s or early 1990s and often based on older technology, such as the IBM AS/400 platform, Progress Software, or even DOS. These systems weren't designed for modern integration requirements, leaving transport teams to bridge gaps through manual processes and custom-built workarounds.

The manufacturing sector led the Europe ERP software market with a 29.3% share in 2024. Yet manufacturing companies face unique integration challenges. European manufacturing, especially in automotive, pharmaceuticals, and food processing, operates under stringent traceability mandates that necessitate end-to-end ERP integration. When transport data exists separately from production and procurement systems, manufacturers lose the visibility needed for just-in-time delivery and quality compliance.

Consider the typical scenario: your ERP triggers purchase orders and production schedules, but your transport team operates independently through carrier portals and email chains. When delivery delays occur, the impact cascades through production planning, inventory management, and customer commitments. By the time finance reconciles transport costs against original budgets, the opportunity for proactive adjustments has passed.

Why Traditional Integration Approaches Fail in Manufacturing

Individual data elements, called tags, in these XML files are proprietary, meaning defined by the source system. They must be transformed or processed before being ready for upload to the destination system. Consequently, many interfaces between TMS and ERP systems require custom-developed transformations and processing. This technical reality explains why so many integration projects exceed budgets and timelines.

ERP projects typically take 15–20 months to complete, with 75% of implementations exceeding their original timelines. When you add TMS integration complexity, these delays multiply. One of the key challenges in TMS and ERP integration is the complexity involved in aligning different data structures, workflows, and business rules. Data mapping, in particular, can be a daunting task as it requires mapping data fields from one system to another while ensuring data integrity and accuracy. Without a well-thought-out data mapping strategy, integration efforts can face significant setbacks.

A German automotive parts manufacturer experienced this firsthand. A mid-sized German automotive parts manufacturer thought their TMS implementation was going smoothly. Six months in, €800,000 spent, and they realized their new system couldn't handle their complex carrier network across 12 countries. Their legacy ERP system from the early 2000s used proprietary data formats that required extensive custom development for each carrier integration.

EDI connections compound the challenge. The first challenge of EDI inside an ERP, TMS, or WMS is that it will be tightly tied to the ERP. When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners. Manufacturing companies often discover that their existing EDI relationships become barriers to system modernization rather than enablers.

EDI integrations may take several months, whereas, API integrations can take a matter of weeks, if not days, and files may have complex formats requiring the labor of specialists. This timing difference becomes critical when manufacturers need to onboard new carriers or adapt to changing regulatory requirements across European markets.

The 2025 Manufacturing Data Integration Landscape

Europe's industrial powerhouses, particularly Germany, are significantly driving ERP demand through the expansion and digital transformation of the manufacturing sector. In 2024, Germany's manufacturing sector contributed 19.7% to the country's gross value added, according to the Federal Statistical Office, reflecting the sector's strategic economic role. These platforms enable real-time data access, streamline production workflows, and support Industry 4.0 integration, making them critical tools for sustaining competitiveness in both domestic and global markets.

At the same time, the integration of Internet of Things (IoT) technology with ERP systems is emerging as a powerful growth enabler, offering real-time data visibility, operational control, and predictive capabilities that enhance efficiency across industries like manufacturing and logistics. Smart factories generate massive data streams that require seamless integration between production systems, transport management, and enterprise planning.

Regulatory drivers accelerate this transformation. European manufacturers face increasing compliance requirements that demand integrated data flows. The upcoming eFTI Regulation will require digital freight documentation across all transport modes, creating new integration touchpoints between TMS and ERP systems. QR code generation and machine-readable format requirements become mandatory by July 2027. Your TMS must generate these automatically for every shipment across all transport modes.

On the other hand, in Germany, the adoption of Industry 4.0, IoT, and AI has risen significantly since the government introduced the concept of Industry 4.0 in 2011. Due to the early adoption of automation and the increasing need to manage production processes effectively, major organizations in Germany are widely utilizing ERP solutions, thereby increasing market demand. Accordingly, the Industry 4.0 initiative, a national strategy initiated by the Ministry for Economic Affairs and Energy (BMWI) and the Ministry of Education and Research (BMBF), focuses on driving digital manufacturing by boosting digitization and interconnecting products, value chains, and business models.

API vs. EDI: The Integration Technology Decision Matrix

European manufacturers face a fundamental choice between API-first integration and traditional EDI approaches. APIs communicate in real-time. APIs transmit data in milliseconds. This allows a transportation management system (TMS) to run on real-time data, whether you're getting tracking updates, building loads or getting spot quotes. For manufacturers operating just-in-time production schedules, this speed difference translates directly to operational capability.

The API is also scalable, allowing systems to grow and handle increased use and/or needs without significant maintenance time required. However, APIs provide a more modern, flexible and efficient solution compared to EDI. APIs allow for real-time data exchange, better integration with other systems and easier implementation and updates. This means that shippers using APIs can adapt more quickly to changes, streamline their operations more effectively and ultimately achieve better performance in their supply chains.

But APIs aren't universally applicable. They may not be as universally accepted as EDI, particularly among larger, more traditional partners. EDI, with its long-established presence, has been the backbone of supply chain operations for decades, offering reliability, security, and standardization. Many European logistics providers and major retailers still require EDI connections for high-volume transactions.

The scalability question becomes critical for growing manufacturers. Roughly 25% of EDI connections have been replaced with APIs as of 2020. That said, legacy applications and technologies are still handling the majority of connections. Often playing the role of the intermediary, freight brokers will stand a far better chance if their TMS systems utilize both API and EDI integrations. Modern TMS platforms like Cargoson, Descartes, and nShift offer hybrid connectivity approaches that support both technologies.

The Five-Phase Implementation Roadmap

Plan ERP integration carefully. Data quality issues between your TMS and existing systems can undermine the entire process. Test integrations thoroughly with actual historical data before full deployment. Based on successful implementations across European manufacturing, here's the proven roadmap:

Phase 1: Integration Architecture Assessment (Weeks 1-4)

Integration planning requires attention to existing ERP systems. Whether you're running SAP, Oracle, or other enterprise software, ensure your chosen TMS provider offers proven integration paths. Document your current data flows, identify critical touchpoints, and map existing EDI relationships. This phase prevents the €800,000 mistake of choosing incompatible systems.

Phase 2: Pilot Lane Implementation (Weeks 5-12)

Start small with one or two transport lanes and specific carriers. More than 50% of organizations opted for a slower, more phased approach to implementation by following a set of predetermined steps when moving to a new system. This approach allows you to validate integration logic and data mapping before scaling.

Phase 3: Core ERP Integration (Weeks 13-20)

Integrating complex systems like TMS and ERP requires careful planning and execution. Challenges such as data mapping, system compatibility, and process standardization may arise. Focus on bidirectional data flows: order information flowing from ERP to TMS, and delivery confirmations, costs, and performance metrics flowing back to ERP.

Phase 4: Carrier Network Expansion (Weeks 21-32)

Scale proven integration patterns across your carrier network. Cargoson offers direct API/EDI integrations with carriers across all transport modes, while Transporeon connects 150,000+ carriers but many integrations are standard EDIs or PDF/email transmissions rather than true API connections. Prioritize carriers representing 80% of your transport volume.

Phase 5: Advanced Analytics and Optimization (Weeks 33-40)

With integrated data flows established, implement predictive analytics and automated decision-making. AI-driven procurement capabilities are emerging across major platforms. These features analyze historical performance, predict market trends, and recommend optimal tender timing. Early adopters report 10-15% additional savings beyond basic automation benefits.

Measuring ROI and Success Metrics

Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings. But European manufacturers should track broader integration benefits beyond immediate freight savings.

Primary financial metrics include direct transport cost reduction, administrative cost savings from eliminated manual processes, and inventory optimization through improved delivery predictability. Cloud-based TMS solutions are expected to register the fastest growth at 18.6% CAGR due to quick setup, low initial costs, and reduced hardware requirements. These platforms typically deliver faster ROI than traditional on-premise integrations.

Operational metrics reveal the true transformation impact. Track data accuracy improvements, system response times, and exception handling efficiency. European manufacturers implementing integrated TMS-ERP systems report 40-60% reduction in transport-related data errors and 30-50% faster issue resolution times.

Compliance metrics become increasingly important. European regulations around emissions reporting and carbon footprints require more sophisticated evaluation methods. Regulatory compliance automation becomes more valuable as European transport regulations evolve. Integrated systems enable automated compliance reporting and audit trail maintenance.

Document your success metrics quarterly. Track cost savings through detailed freight spend analysis, efficiency improvements through process time measurements, and user satisfaction through adoption rates and feedback scores. Benchmark against industry standards from transport management associations and ERP vendor benchmarking reports.

Avoiding the €800,000 Implementation Trap

A German automotive parts manufacturer just learned what a €800,000 TMS implementation mistake looks like. They chose a North American-focused platform six months before discovering their primary carriers couldn't integrate without costly custom development. This scenario repeats across European manufacturing because companies underestimate the complexity of regional carrier networks and legacy ERP constraints.

Red flags appear early if you know what to watch for. When TMS vendors can't demonstrate direct integration with your ERP version, when they require "custom development" for standard carrier connections, or when implementation timelines keep extending beyond original estimates. Major players like Oracle TM, SAP TM, and Blue Yonder offer enterprise-grade solutions, but implementation complexity often delays projects. Mid-market alternatives including Cargoson focus on faster deployment with eFTI readiness built-in.

Change management failures cause more project disasters than technical issues. Among companies that completed an ERP implementation, 77% said the most critical success factor was institutional leadership support. In addition, 60% said the top skill needed for a successful implementation was effective communication with all stakeholders. European manufacturing teams need extensive training on integrated workflows, not just new software features.

To overcome integration challenges, organizations should collaborate closely with their IT teams, solution providers, and internal stakeholders. Thoroughly test and validate the integration before going live, ensuring all systems and processes are working seamlessly together. Ongoing monitoring and continuous improvement are also essential for maintaining a successful integration.

Testing methodologies prevent expensive discoveries late in implementation. Use actual historical data for integration testing, not synthetic test cases. Validate data flows under peak load conditions, not just steady-state operations. Test failure scenarios and recovery procedures before production deployment.

Future-Proofing Your Integration Strategy

European transport regulations continue evolving rapidly. QR code generation and machine-readable format requirements become mandatory by July 2027. Your TMS must generate these automatically for every shipment across all transport modes. Platform selection determines your compliance success and operational efficiency. Choose integration platforms with proven regulatory adaptation capabilities.

The European TMS market reached €1.4 billion in 2024 and is growing at 12.2% annually, driven by companies modernizing manual processes and regulatory compliance requirements. This growth creates opportunities for manufacturers to leverage proven integration patterns and vendor experience rather than pioneering custom solutions.

AI and machine learning integration represents the next evolution. More than 65% of organizations believe AI is critical to their ERP systems. Forty percent of businesses surveyed said AI was an important consideration for their ERP application investment, and nearly 16% said embedded AI was a must-have for their ERP software. A recent survey found that adding AI to some business processes led to dramatic improvement of the organization's ERP performance.

By the end of 2024, 49% of cloud buyers had deployed predictive AI, 46% interpretive AI and 51% GenAI. On-premise systems typically lag 2-3 years behind in AI integration due to hardware limitations and update complexity. The technology leaders understand this shift. Companies are increasingly leveraging digital twins, cloud-based analytics, and real-time performance tracking to ensure resilience and scalability.

Vendor roadmap evaluation becomes critical for long-term success. Choose platforms with clear AI integration plans, regulatory compliance automation capabilities, and strong developer ecosystems. Avoid vendors focusing solely on current functionality without clear innovation strategies.

Your integration architecture should support emerging technologies like blockchain for supply chain transparency, IoT sensors for real-time cargo monitoring, and autonomous transport systems. Modern API-first platforms provide the flexibility needed for these future integrations, while legacy EDI-only systems create technical debt that compounds over time.

Start your integration planning today. The European transportation management systems market, valued at USD 2.70 billion in 2022, is growing at 12.1% annually and forecasted to reach €2.1 billion in 2028, yet over 60% of companies still operate on-premise systems despite cloud deployment leading with 63% revenue growth in 2024. This creates a critical window. Companies clinging to legacy systems while competitors leverage cloud advantages face escalating costs and diminishing returns. The data integration gap between TMS and ERP systems won't solve itself, but the solutions are proven and available now.